While a face off between Donald Trump and Hillary Clinton in November seems ever more likely, Main Street is watching closely for key issues to be addressed.

But what's lacking so far are details, especially when optimism is wavering among small business owners. Recent data from Wells Fargo and the National Federation of Independent Business' latest optimism indexes show sentiment taking a dip, due in part to uncertainty over the economy and the political climate.

Wells Fargo also finds nearly 70 percent of entrepreneurs said the candidates are not discussing the issues that are most important to them.

"Overall we are disappointed by all of the campaigns—there's really not a lot of true small business focus out there," says Molly Day, spokeswoman for the nonpartisan National Small Business Association. "As far as I've seen, no one has a concrete plan."

From taxes to wages and health care, here's a breakdown of where the candidates stand.

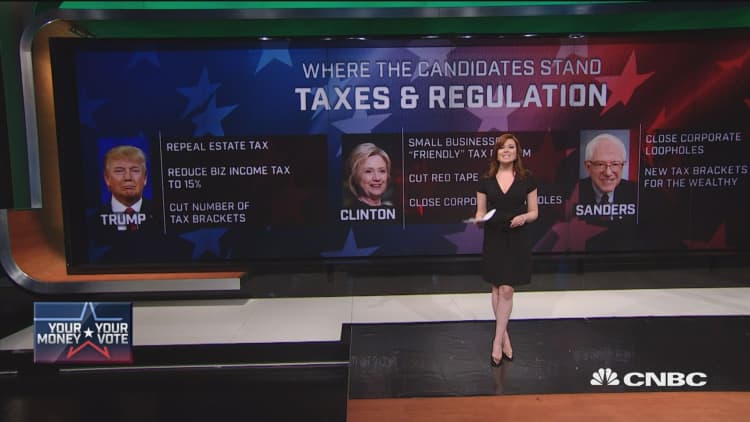

Taxes and regulation

All three candidates vow to simplify the tax code, a welcome message on Main Street. The Wells Fargo poll, released Wednesday, found business owners named changes in the tax code and regulations as the issue they most want addressed.

Under Trump's tax plan, no business of "any size" will pay more than 15 percent of their business income in taxes. He has also vowed to repeal the estate tax, which taxes transferred property post-death, something critics say hurts small companies, according to DonaldJTrump.com. Trump's personal income plan has four brackets—0 percent, 10 percent, 20 percent and 25 percent. And Trump said on CNBC Thursday he would be "getting rid a tremendous amount of regulation."

Clinton has spoken about enacting tax reform that is friendlier to small businesses, and also vows to cut red tape at "every level of government," according to HillaryClinton.com. She voted against eliminating the estate tax, and has focused her proposal on reforming the tax code so that the "wealthiest pay their fair share."

Bernie Sanders establishes four new personal income tax brackets of 37 percent, 43 percent, 48 percent, and 52 percent, while raising the seven other brackets by 2.2 percent. The Vermont Senator wants to increase access to low-interest loans for small businesses by re-instating the Glass-Steagall Act, which separates commercial banks and securities activity.

Wages

Wages are heavy on the minds of Main Street entrepreneurs over the past two years thanks to a strengthened move by cities, states and companies toward $12 to $15 an hour minimum wage.

Both Clinton and Sanders are in favor of raising the minimum wage, Clinton to $12 an hour at the federal level, Sanders to $15 an hour.

Meanwhile Trump has made conflicting statements on wages on the campaign trail, but said this week he is "open to doing something" with the country's minimum wage.

Health care

Wells Fargo also found health care ranked a top-three issue for business owners polled. Trump has vowed to repeal and replace Obamacare with a national marketplace on his first day in office. Meanwhile Clinton is in support of the Affordable Care Act, and would like to see it further strengthened.

Sanders is in favor of a single-payer health-care plan, that separates health insurance from employment, which would allow people to "start new businesses," according to BernieSanders.com.