Investing legend Warren Buffett is known for his buy-and-hold strategy.

"The money is made in investments by investing," Buffett tells CNBC, "and by owning good companies for long periods of time. If they buy good companies, buy them over time, they're going to do fine 10, 20, 30 years from now."

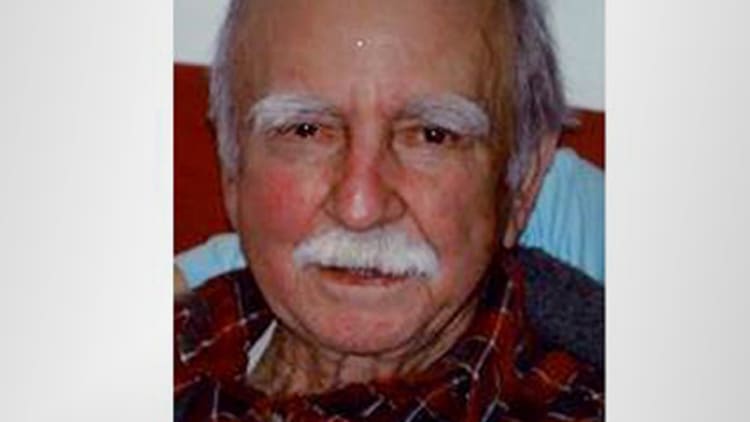

Chicago-based Russ Gremel, 98, did just that about 70 years ago when he bought $1,000 worth of Walgreens stock. "He figured people would always need medicine and women would always buy makeup," the Chicago Tribune reports. "He planned to hold onto that stock for a long time, as an investment."

Gremel's discipline paid off. Today, his 28,000 or so shares are worth more than $2 million, and he turned over all of that to the Illinois Audubon Society to build a wildlife refuge.

In addition to making smart investments, the retired lawyer has always been careful with his money. He's never had a mortgage — he lives in the same home where he grew up. His previous car lasted him 25 years. And he'd rather eat oatmeal at home than go out.

Gremel's frugality, coupled with the fact that he's never been married or had children to support, allowed him to retire at age 45.

Up until Gremel donated the $2 million, few people knew of his small fortune. "I'm a very simple man," he tells the Chicago Tribune. "I never let anybody know I had that kind of money."

The investor isn't entirely an anomaly. One-time janitor Ronald Read of Vermont secretly amassed $8 million, thanks to similar choices: A frugal lifestyle and Buffett's buy-and-hold investing strategy.

Read, who left $6 million to his local library and hospital, owned about 95 stocks at the time of his death, many of which he had held onto for decades.

As Buffett likes to say: "It's pretty easy to get well-to-do slowly. But it's not easy to get rich quick."

Don't miss: A janitor secretly amassed an $8 million fortune and left most of it to his library and hospital