Establishing smart money habits early on can mean huge financial gains down the road. It can even make you a millionaire.

To help you get on track financially, CNBC Make It has rounded up five things highly successful people do with their money before turning 30.

They prioritize high-interest debt

Not all debt is created equal. An effective strategy for paying it off is to rank all of your debt in order of interest rate, from highest to lowest. Then prioritize the debt with the highest interest rate, while still paying the minimum on all of your debts, in order to pay less over the lifespan of your loans.

There is an alternate option, too: Rank your debt in order of size and start with the smallest. It's a strategy that personal finance expert Dave Ramsey calls the "snowball method." The idea is that each time you pay off one form of debt, you build momentum, which helps you tackle the next biggest, and so on.

They spend less than they earn

The wealthiest people tend to have the discipline to keep a large chunk of their paycheck. Take former host of NBC's "The Tonight Show" Jay Leno, who saved every dime of his "Tonight Show" money.

From the moment he entered the working world, "I always had two incomes," he tells CNBC. "I'd bank one and I'd spend one." And he made sure to spend the smaller amount.

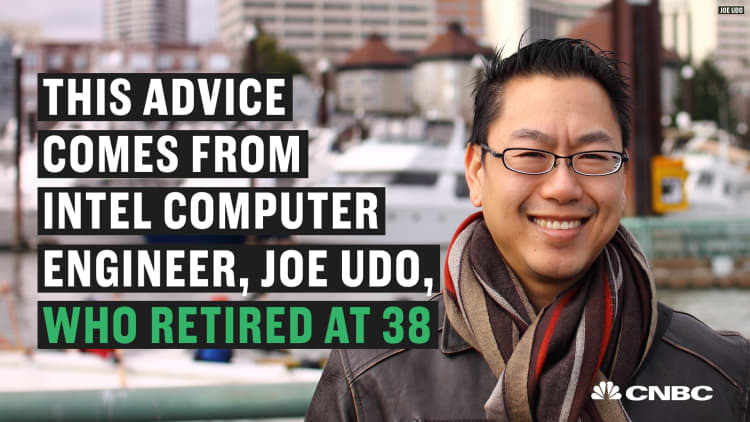

Early retirees have also used this strategy to reach their money goals faster.

They set specific money goals

"The No. 1 reason most people don't get what they want is that they don't know what they want," self-made millionaire T. Harv Eker writes in his book "Secrets of the Millionaire Mind." "Rich people are totally clear that they want wealth."

Think about what you want your future to look like and then come up precise savings goals. Do you want to be able to afford a home? Grad school? Trips abroad?

Calculate how much you need to save for these future expenditures and for how long, and start setting aside a certain amount each week or month. It's easier to work when you know what you're working towards.

They save and invest for the future

Investing is one of the most effective ways to , and the sooner you start putting your money to work, .

Besides saving for bigger future purchases and sending a chunk of your paycheck to , you'll want to put money in that could cover at least three-to-six months' worth of living expenses.

They get paid what they're worth

"There is nothing more important to securing your financial future than getting paid what you are worth," , who went from having $2.26 in his bank account to $1 million in just five years.

This might mean negotiating your salary or asking for a raise. Before doing so, do your homework. Read up on costly negotiation mistakes, negotiation tips and career expert Suzy Welch's top advice.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Self-made millionaire: Not buying a home is the single biggest millennial mistake