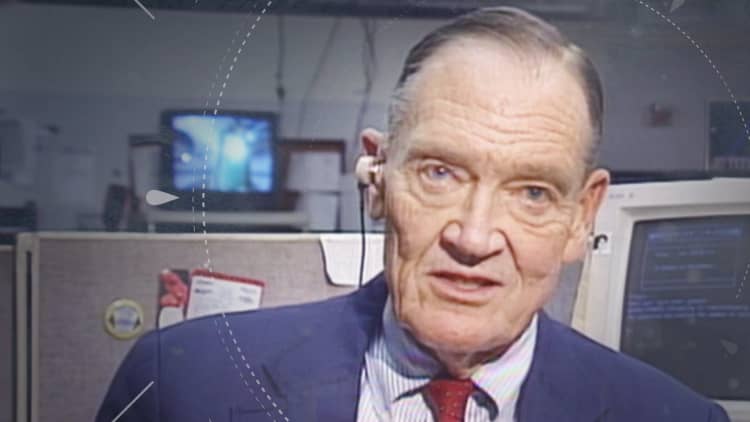

Jack Bogle, father of the index fund and one of the world's greatest investors, died Wednesday at age 89.

The legendary investor's strategy was simple, yet highly effective: buy and hold for the long term.

"If you hold the stock market, you will grow with America," Bogle, founder of The Vanguard Group, said in 2018 on CNBC's "Power Lunch."

In the long run, there is a high correlation between the stock market and U.S. economic growth, he said. So, even when the situation is volatile, "stay the course. Don't let these changes in the market, even the big one [like the financial crisis] … change your mind and never, never, never be in or out of the market. Always be in at a certain level."

If you try to trade in and out of the market, "your emotions will defeat you totally," Bogle added. "Short-term betting is not a good way to go."

Smart investing is "all about common sense," Bogle preached in his book "The Little Book of Common Sense Investing." "Owning a diversified portfolio of stocks and holding it for the long term is a winner's game. Trying to beat the stock market is theoretically a zero-sum game (for every winner, there must be a loser), and after the substantial costs of investing are deducted, it becomes a loser's game.

"Common sense tells us — and history confirms — that the simplest and most efficient investment strategy is to buy and hold all of the nation's publicly held businesses at very low cost."

That's why he recommended investing in low-cost index funds, which are broadly diversified, hold many stocks and operate with minimal expenses. It's "the only investment that guarantees you your fair share of stock market returns," he wrote.

Owning a diversified portfolio of stocks and holding it for the long term is a winner's game.Jack Boglefounder of The Vanguard Group

Besides creating the index mutual fund in 1975, Bogle wrote 13 books on investing, including "Stay the Course," which came out in 2018.

"If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle," investing legend Warren Buffett wrote in his 2017 annual shareholder letter.

"In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me."

Don't miss: Jack Bogle shares the $1 billion investing mistake that cost him his job

Like this story? Subscribe to CNBC Make It on YouTube!

WATCH: