How much of your paycheck should go towards housing? What about savings? Or entertainment and vacations?

While the specific answer varies from person to person, anyone can use the "50-30-20 formula" to help them figure out how much to spend and save, says Sallie Krawcheck, co-founder and CEO of Ellevest and former Wall Street executive at Morgan Stanley and Citibank.

Here's how it works.

50% of your income goes to needs

Half of your take-home pay should go towards necessities, Krawcheck tells CNBC Make It: "That's your rent, that's the car that you need to drive to work, that's your work wardrobe."

This category also includes things like food, insurance and childcare.

30% of your income goes to fun

Nearly one-third of your money can be directed towards "fun," such as travel and going out to eat, says Krawcheck. "We're only on this earth a short amount of time," she adds. "We need to have fun."

But think about what matters to you before spending this money. As research shows, how you spend is oftentimes more important than your overall income or the amount you spend in total.

Money experts suggest you spend on experiences, such as trips or classes, rather than things. "All of the best psychological research on money and happiness tell us that spending money on experiences brings more (and more lasting) happiness than spending money on material objects," Ron Lieber, New York Times columnist and author, tells CNBC Make It.

20% of your income goes to savings

The remaining 20% goes to your future self, including retirement funds and saving for major purchases, such as a home or car.

"For a lot of folks that can be difficult to get to," Krawcheck says, "so start with 1%." Then, aim to gradually increase that amount over time.

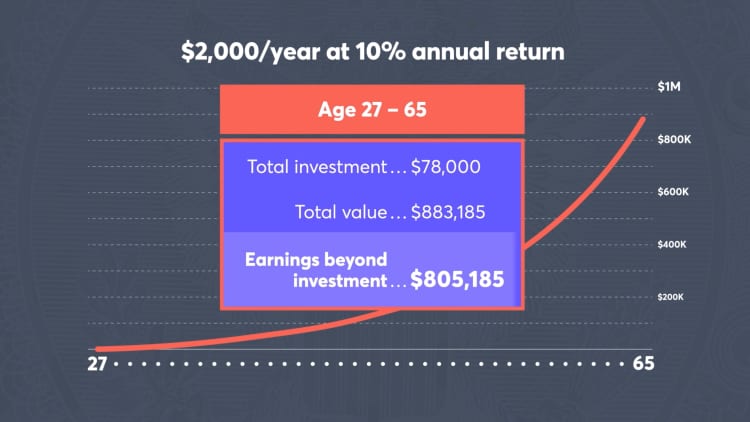

You don't just want to save this money, she adds. You want to invest it and make it work for you. That means contributing to your employer's 401(k) plan if they offer one or saving in other retirement accounts, such as a Roth IRA or traditional IRA.

You can also research low-cost index funds, which Warren Buffett recommends, and online investment platforms known as robo-advisors.

CHECK OUT: How going cash-only helped this 23-year-old pay off $20,000 in debt in one year via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.