Wendy's affordable prices have long been wallet-friendly. But investing in the company itself can also pay off.

The company's stock surged Wednesday after its second-quarter earnings and North American sales topped expectations. The restaurant also said it was making strides in speeding up service times and integrating delivery provider DoorDash into its system. The shares are now up more than 25% this year, topping McDonald's stock gain. The current stock price is currently hovering around $20.

If you invested in Wendy's 10 years ago, you'd have made a profit. A $1,000 investment in 2009 would be worth nearly $4,500 as of Aug. 7, 2019, for a total return of close to 350%, according to CNBC calculations. By comparison, a $1,000 investment in the S&P 500 would have earned a total return of 251% over the same period.

Although Wendy's stock has done well over the years, any individual stock can over- or underperform and past returns do not predict future results.

CNBC: Wendy's stock as of August 7, 2019.

Several restaurant chains, including McDonald's, Chipotle and Starbucks, reported solid earnings for Q2 after launching new menu items. Wendy's is no different. The burger chain has continued to revamp its menu and restaurant locations. New additions to the menu include the "$5 Biggie Bag Combo," which comes with a bacon cheeseburger, four-piece nuggets, small fry and a small drink, plus a Parmesan Caesar chicken salad as a part of the "Made to Crave" menu.

Despite estimations that Wendy's would fall flat in its second quarter due to strong marketing efforts from its competitors, the company managed to surpass expectations, boosting its shares 8%. Still, it can't be overlooked that the company's revenue fell nearly $5 million short of projections, which can be attributed to intense competition in the highly saturated U.S. fast-food market.

Like many of its rivals, Wendy's continues to focus on expanding its delivery services. Currently, the company partners with delivery service DoorDash to cover more than 80% of its U.S. locations, which contributed to the same-store sales increase.

Going forward, Wendy's is looking to add plant-based proteins to its menu, which falls in line with what some of its biggest rivals are doing. This month Burger King launched its plant-based "Impossible Whopper" nationwide, and White Castle also saw success when it launched its version of the Impossible Burger, the "Impossible Slider," earlier this year.

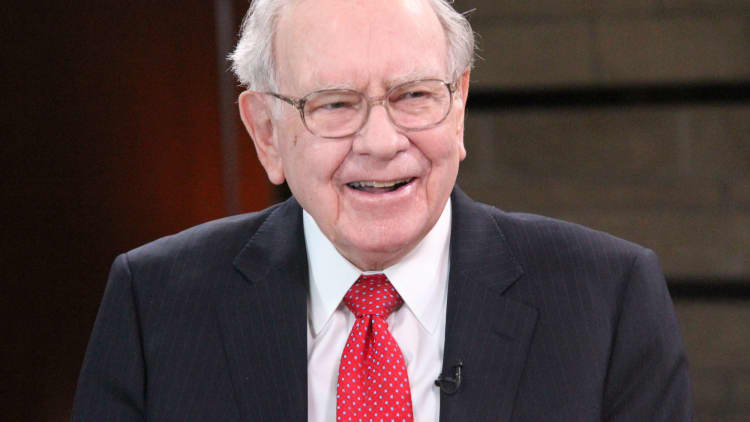

If you are thinking about getting into investing, experts often advise starting with index funds, which hold every stock in an index, such as the S&P 500. Seasoned investor Warren Buffett agrees that it's a smart idea to start with index funds, in part because they fluctuate with the market, making them less risky than individually selected stocks.

Here's a snapshot of how the markets look now.

Don't miss: If you invested $1,000 in Chipotle 10 years ago, here's how much money you'd have now

Like this story? Subscribe to CNBC Make It on YouTube!