The U.S. is officially experiencing an economic recession, according to a Monday statement from private non-profit research organization National Bureau of Economic Research. While many experts and economists generally define a recession as a GDP decline in back-to-back quarters, they defer to NBER to officially make the call.

"In deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration and whether economic activity declined broadly across the economy," the National Bureau of Economic Research said in a statement Monday. The organization concluded that the "unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions."

Economists say the factors leading up to the current economic slowdown, such as how fast it hit and who it is affecting, are different from previous economic downturns and may lead to a different outcome.

It's a "very unusual circumstance that we find ourselves in," says Cecilia Rouse, an economist and the dean of the Woodrow Wilson School of Public and International Affairs at Princeton University. "Covid-19 has already exacted an immense impact on the economy."

Here's a look at three major ways this pandemic-driven recession is different than previous downturns, such as the Great Recession, and what those contrasts could mean for recovery.

The source of the current recession is not financial

In previous recessions, the economic downturn resulted from issues in the financial markets, oil prices, monetary policy or a specific sector in the economy. The Great Recession, which lasted from December 2007 until June 2009, was brought on by a subprime mortgage crisis and lax lending standards that led to the collapse of the mortgage industry.

One of the causes of the so-called Reagan Recession, which lasted from July 1981 until November 1982, was the Federal Reserve's monetary policy, which raised interest rates to curb high inflation.

But the current recession was caused by a public health crisis.

"It was not started because of a crisis in the financial sector, such as the last Great Recession," Rouse says. Because of the current health concerns, "the remedy is for us to stand down and pause the economy."

In that way, it's a self-induced recession, which is highly unusual in the U.S., says Jason Furman, an economist and professor at Harvard Kennedy School. He compares the current U.S. economy to a "medically induced coma."

It's worth noting that pandemics and public health crises have affected economies in other parts of the world before. In West Africa, the 2014 Ebola virus outbreak led to major economic fallout, affecting trade, employment rates and GDP growth, according to a report from the United Nations.

The speed of the economic collapse

What's particularly unusual about the current recession is the speed at which it's hit, particularly when it comes to unemployment, says Joseph Stiglitz, a Nobel Prize-winning economist and professor at Columbia University.

"Covid-19 has resulted in the most rapid shutdown of economic activity that the U.S., or the global economy, has ever seen," Furman says.

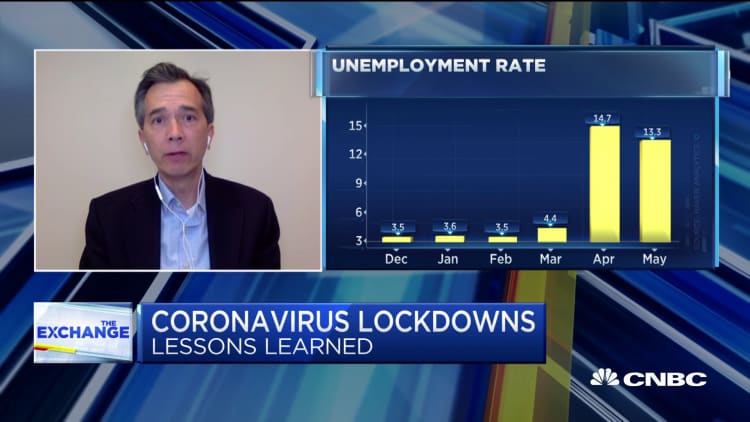

Normally, even in a minor economic downturn, there will be a few hundred thousand new applicants for unemployment. But within a matter of weeks, the number of Americans filing for unemployment this time around had soared into the millions and continued to increase by several million each week. "These are just unheard of numbers," Stiglitz says.

While NBER officially determined the Great Recession started in December 2007, the unemployment rate didn't peak until October 2009.

The Great Depression, which lasted about 10 years from 1929 to 1939, was precipitated by the stock market crash in September 1929. Yet it wasn't until the 1930s that the banks collapsed.

This time, the U.S. is shutting down the economy very quickly. Just weeks into the current crisis, unemployment surpassed the 10% peak recorded during the Great Recession. That raises the question of how easy it will be to get the economy fully going again, Stiglitz says.

The scope of the current recession is wide

"The most distinguishing characteristic is that this [downturn] is so much more pervasive," Stiglitz says. The Great Recession was an economic slowdown that began in finance and trickled down to the rest of the economy, Stiglitz says. But now, everyone is affected. It's hitting everywhere all at once, from travel to food service to health care.

That makes it difficult for the government to boost economic activity and end the recession. Typically, when the private sector is not fully functioning, the public sector steps in to help, Rouse says. That public sector role is usually taken on by federal and state governments, particularly during economic downturns. During the Great Depression, for example, President Franklin Delano Roosevelt's administration created the Works Progress Administration, which put over 8 million Americans to work on public projects.

"What's unusual here is we actually don't necessarily even want people out doing the kinds of things that the federal government could have them do," Rouse says. "We don't want people in groups of more than 10 people together."

This chart shows the employment gains and losses across different U.S. industries in May 2020 as some states started to reopen from the coronavirus pandemic.

The differences between this coronavirus-spurred economic recession and previous downturns make it difficult to determine the outcome.

Many economists believe the U.S. will undergo a longer "U-shaped recession," where the economic output drops and then bounces back in fits and starts before eventually climbing again, similar to how the Great Recession played out. An April Reuters poll found nearly half of 45 economists surveyed believed the U.S. recovery would be U-shaped. But that doesn't mean the current recession, even if U-shaped, will last as long as the Great Recession.

Others expect that because the shutdown was temporary, the U.S. will experience a quicker and more dramatic "V-shaped" recovery where the country's GDP takes a sharp and rapid downturn followed by a violent upswing.

"This is almost certainly the deepest recession" since World War II, Jan Hatzius, chief economist at Goldman Sachs, wrote in a note Monday. While deep, "it is almost certainly also the shortest recession" since the war as well, Hatzius added.

"This is not a typical economic crisis," Rouse says, adding that most economists believe the economy is fundamentally strong. But the longer the coronavirus pandemic affects daily life and the longer the U.S. is not able to bring the virus under control, the more damage it will do to the economy.

"I remain optimistic that we will get through this and that there will be another side, but we will require some patience and some cooperation and some generosity toward our neighbors right now," Rouse says.

Check out: The best credit cards of 2020 could earn you over $1,000 in 5 years