During your next night out (or Zoom call in) with your friends, break open the wine and talk about investments. It might sound weird at first, but that's what Divya Gugnani, CEO and co-founder of Wander Beauty, advises women to start doing.

"Every time my husband goes out for a guy's dinner, why do they discuss investments, why are they talking about the stock market, why are they talking about real estate?" Gugnani asks. It's because it works. "They come home and they share ideas, and their wealth compounds," she says.

It's time women do the same.

"We need to socialize the idea that it's OK for us to talk about money. We need to share and build and help each other grow," Gugnani said during a recent webinar as part of U.S. Bank's Women & Wealth Summit.

About 52% of women say they talk about money with friends, compared to 61% of men, according to U.S. Bank's online survey of 3,000 people last year.

Men build wealth, in part, because they are sharing their financial ideas and insights with a network of others, says Gugnani, who started her career at Goldman Sachs. They help, teach and support each other, she adds.

Women can and should be doing the same thing, Gugnani says. Start with your own circle of friends and move past the taboos and hang-ups you may have about talking about money and finances in general. "Make this an OK thing to talk about at a girl's dinner," she says.

"It's about learning how to become financially fluent, financially literate," she says.

When it comes to money advice, Gugnani says her No. 1 recommendation is to invest. "Make sure you're investing, whether it's stocks, bonds, real estate, private companies," she says. "Find something that you're passionate about and you want to learn and take ownership of, and invest your money so it can compound."

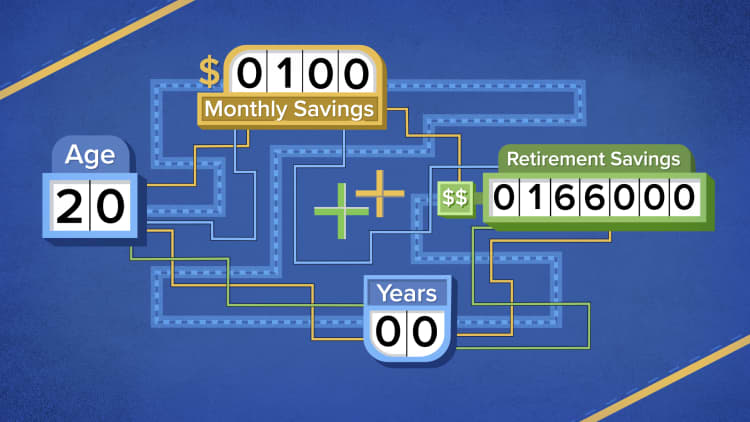

That's because in many cases, wealth builds wealth. Investing early (and often) means that you'll have more time in the market to let your investments grow. The bigger your investment, the bigger the potential for a higher rate of return.

"The onus is on us to change the entire narrative around money," Gugnani says.

To hear from top experts in personal finance and get critical advice on spending and saving to stay financially afloat, join the CNBC Path Forward: Your Money Summit on November 17, featuring Suze Orman, Patriots linebacker Brandon Copeland, The Budgetnista founder Tiffany Aliche and more.

Don't miss: 4 steps young people can take to start building wealth, even in a recession