It may turn out the economy did not grow at all in the first quarter.

Trade data released Tuesday show the U.S. deficit widened more than expected to $47.1 billion in February and was a bigger drag on growth than expected. It's the latest economic metric that chiseled away at the tracking model for first quarter growth.

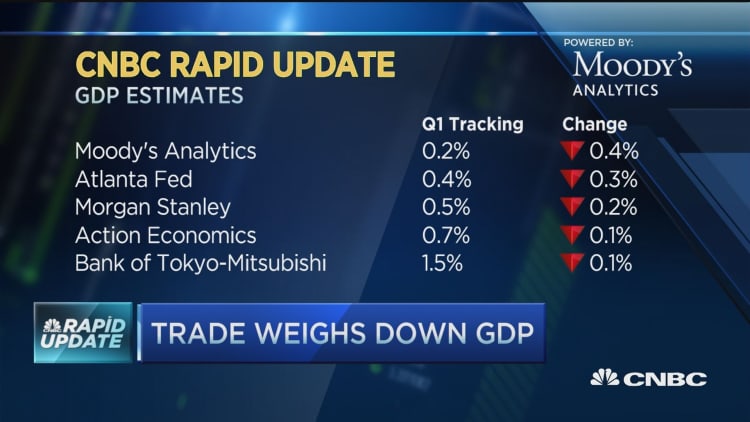

The median of economists who participate in the CNBC/Moody's Analytics Rapid Update is now 0.5 percent for tracking GDP growth, down from 0.9 percent last week. Their average forecast for growth is 1.1 percent.

Given the average, and substantial, revisions to government GDP data, that 0.5 percent could easily turn into a negative number, or a much higher number. That is based on a CNBC study that examined every report going back to 1990 and found an average error rate of 1.3 percentage points in either direction.

Read MoreTrade deficit widens in February

The widely followed Atalanta Fed's GDPNow model sees the economy expanding by just 0.4 percent, down from 0.6 percent. Tracking forecasts are based on the data that has been reported.

But not all economists agree the trade numbers are negative for growth.

Goldman Sachs economists saw a bright side in the data and said the increase in activity and underlying details were positive. They left their tracking estimate at 1.2 percent.

JPMorgan economists said the trade report showed good increases in trade flows but the increase in the export side was more modest than expected. The economists said exports look to be subtracting a half percent from GDP, and they put tracking GDP at 0.7 percent for the first quarter.

Real goods exports rose 2.2 percent in February, after declines in four of the last six months. "The recent dollar deprecation should lead to some strengthening in exports," the JPMorgan economists wrote. But they added it's not clear if the gain in exports represents a change in trend or noise in the data.

Real imports rose 2.3 percent, reaching one of the highest levels on record, but there should be some payback from this, the JPMorgan economists added.

GDP growth was also revised last week when an unusually sharp revision to January's spending data wiped out earlier solid gains and showed spending marginally higher — at 0.1 percent from an earlier 0.5 percent.

Read MoreISM reports March non-manufacturing gain

"What's interesting is it looks like the big downward revision in retail sales in January which had been a boom and then a bust. You can't explain the hiring in retail in the month of March. ... It really is this issue of we're probably undercounting retail right now," said Diane Swonk, founder of DS Economics.

Swonk said gasoline sales have become a big part of the mix of sales at retailers like Costco, and the government data count those sales in the same model. That means the drop in gasoline prices this winter was embedded in the consumption data.

Read MoreIMF's Lagarde: No crisis, but news not so good

Economists had been hopeful the first quarter would be the snapback quarter with growth above 2 percent. Fourth quarter GDP growth was reported at 1.4 percent Friday, revised up from 1 percent.

On a positive note, the ISM nonmanufacturing index Tuesday rose to 54.5, more than the 54.2 expected. New orders rose to 58.5 from 53.5, an encouraging sign.

Read MoreFourth-quarter GDP revised