Parents with three or more children could face a seven-figure bill for school by the time all the kids walk across the stage. If you are in this situation, you have options beyond hoping one or more of your kids is a star athlete or full-ride genius.

The average expense of sending a child to college has been rising at double the rate of inflation for more than a decade. Vanguard estimates that in 18 years a four-year degree at a private college could cost nearly $500,000. (See table below.)

"Sending your child to college used to be like buying a car, now it's like buying a house," said Melissa Sotudeh, a certified financial planner and wealth advisor at Halpern Financial in Ashburn, Virginia, who wrote the e-book "Find Your Financial Safety School."

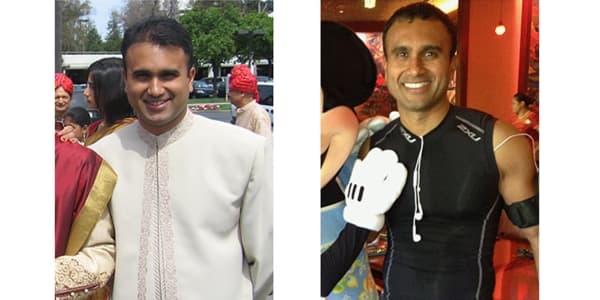

If you are feeling overwhelmed, meet Frank and Debbie Astorino. They paid for the education of their four children using a combination of 529 college savings plans and gift trust accounts.

Sending your child to college used to be like buying a car, now it's like buying a house.Melissa Sotudehwealth advisor at Halpern Financial in Ashburn, Virginia

It all starts with a plan. Frank, a certified financial planner and president of The Astorino Financial Group in Fairfield, New Jersey, developed a college savings strategy before his triplets — Kerri, Kevin and Sherri Astorino — were born.

"When you are going through 20 diapers a day, you don't need financial stress on top of that," Frank said.

529 college savings plans

The Astorinos opened a tax-advantaged 529 college savings plan for each of their children. Not sure exactly what a 529 college savings plan does? You're not alone.

Nearly 3 in 4 investors don't know what a 529 plan is, according to a 2016 survey by the investment firm Edward Jones. Sallie Mae, the largest private student lender, found that only 16 percent of parents used 529 plans or other college savings options for the 2015-16 academic year, down from 17 percent a year earlier.

Thirty-three states and the District of Columbia sweeten the deal by giving residents a tax break if they invest in their state's 529 plan. Five states — Arizona, Kansas, Missouri, Montana and Pennsylvania — offer a state income tax deduction to residents for any 529 plan contributions.

Beyond the tax benefits, investors should know about the two types of 529 college savings plans: those sold directly by the states and those sold through financial advisors. (To make matters more confusing, there are also 529 prepaid plans that allow account holders to buy tomorrow's tuition at today's prices at in-state public colleges and certain private schools.)

Direct-sold 529 plans generally have lower investment fees than advisor-sold ones. However, advisor-sold plans tend to offer more investment options.

Parents of multiples or several children may have to consider investing aggressively to meet their college savings goals, said David Frisch, a CFP and president of Frisch Financial Group in Melville, New York.

Frisch, the father of 14-year-old triplets, has 529 plans for each of his children, and he uses the same investment strategy for all of them.

"If any one of them had one more cent than the other, there would be hell to pay," Frisch said. "My biggest fear now is potentially having all three graduate on the same day in three different places."

Gift trusts

Frank Astorino set up gift trusts for his kids, too. In some states, these trusts, known as Uniform Gift to Minors Act (UGMA) or Uniform Trust to Minors Act (UTMA) accounts, allow parents, grandparents and other donors to give children financial gifts free of gift taxes up to a certain limit without the hassle hiring an attorney to set up the fund.

You have to look at the tax benefits of the plans and figure out the best and most consistent way to save for your kids' education.Frank Astorinopresident of The Astorino Financial Group

One advantage of these trust accounts is you can invest in a wide array of securities and funds because "investment options in 529 plans are mediocre," he said.

Keep in mind that student assets are counted at a higher rate for financial aid purposes than assets in 529 plans. A student's UGMA/UTMA accounts are assessed at a rate of 20 percent compared with 5.6 percent for a parent's 529 plan assets for the Free Application for Federal Student Aid.

You can convert your kids' trusts into 529 plans, Gary Carpenter, a certified public account and college planner with National College Advocacy Group in Syracuse, New York. That way assets in the trust accounts are treated the same as parents' assets at a rate of 5.6 percent. It's best to do the trust transfer by your child's sophomore year to make filling out the FAFSA forms easier, Carpenter said.

Roth IRAs

Astorino made sure that his children's earnings from summer jobs went into a Roth IRA.

Kids can contribute up to $5,500 to Roth IRA. Because his children didn't earn much when they were working for their father, they didn't have to pay much in the way of income taxes when they put money into the Roth.

Typically, if you withdraw money from a Roth IRA before you reach age 59½, you would pay a 10 percent early distribution penalty on the money you take out. However, you and your children can withdraw the money penalty-free from a Roth if you use it for qualified education expenses.

"You have to look at the tax benefits of the plans and figure out the best and most consistent way to save for your kids' education," Astorino said.