"In our early 20s we don't always make the best decisions. For most of us, those decisions aren't catastrophic," said Ryan Wibberley, CEO of CIC Wealth in Rockville, Maryland.

For players in the National Football League, it's a different story.

"It's very common to spend recklessly," said former NFL tight end Steve Maneri. "It's really hard as a young athlete; you don't really understand the value of a dollar."

For that reason, nearly 80 percent of retired NFL players go broke in their first two years out of the league, according to Sports Illustrated.

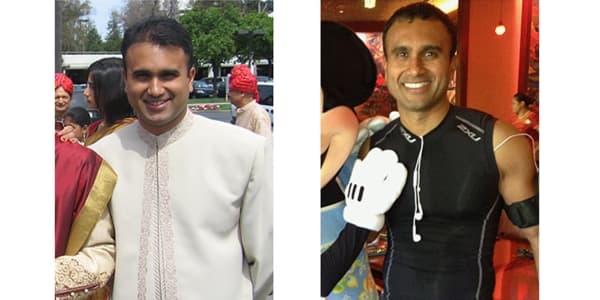

Mario Henry was one of them.

"I wasn't a marquee player, I was let go before my third year so I didn't qualify for a pension. Guys like me go in and out," he said. "I spent two years in the NFL and four to five years trying to get back in the NFL. My money ran out."

Henry signed with the Patriots in 1994 and went on to play for Buffalo. He said he was making about $107,000 a year.

"When my career was finally over and I gave up on the NFL, I was broke," Henry said. "I saw that my teammates, even the ones that were making a lot more than me, were also broke."

To avoid that same fate, Maneri, who played for the Kansas City Chiefs, Chicago Bears, Tampa Bay Buccaneers, New England Patriots and New York Jets, teamed up with Charles Princiotto, a vice president of wealth management at Battery Park Financial Partners, an advisor he could trust.

Together, they came up with a plan to save 60 percent to 70 percent of his income and invest in stocks, ETFs and mutual funds.

That became crucial when his career ended and Maneri spent a year and a half with no income at all, which is common among retired players. He has since started a second act as a commercial real estate agent in New York.

To protect yourself and your retirement, it's important that you understand the type of advice you're getting when you meet with your advisor. Here are the key questions you should ask.

Former NFL player Patrick Kerney is another exception. After 11 years with the Atlanta Falcons and the Seattle Seahawks, the Pro Bowl player socked away the bulk of his income mostly by spending conservatively and staying away from too-good-to-be-true investment opportunities.

After Kerney retired, he earned an MBA from Columbia University and went on to give financial advice to other NFL players.

"When we are in our 20s we are full of testosterone and full of a pride and for us to say 'I don't know,' it's hard to do," Kerney said. "Not many men can say that."

"One-hundred percent of us should have an annual surplus and we need to get educated on what to do," he said. "Don't let ignorance be your downfall."

Don't let ignorance be your downfall.Patrick Kerney11-year NFL veteran

"For an athlete, they're making more at that point than they'll make in the rest of their life, and they don't have the chance to recover. They'll never have a chance to make that money again," Wibberley said.

"What I would tell any athlete: Get help from a financial perspective, a lawyer, an advisor or even a parent," he said.

It's very important for people to "surround themselves with a good team so you have some checks and balances," said Ken Nolan, a managing director at CBIZ MHM in New York, which includes an accountant and an attorney who are independent from each other.

"And that's not just limited to athletes."

More from My Success Story:

Why a guy who built a $600 million hedge fund gave up Wall Street

Get dirty: This CEO built an $11 million cleaning empire

This couple turned $10,000 into an $800,000 clothing business