In his decades of investing, CNBC's Jim Cramer has never liked the month of September. But this one turned out to be different.

"Somehow, we didn't get hit with a tidal wave of selling that many expected ... despite all the sturm und drang about little Rocket Man in North Korea or the sheer impotence of Congress or Trump's tweets that often seem, let's say, out of step with folks like Washington, Jefferson [and] Lincoln, to name three of our more presidential presidents," the "Mad Money" host said.

Historically, September is a bad month for stocks, a month Cramer said he feared since he got into the business.

It's often the month when hedge funds, looking to preserve their quarterly gains, sell everything and revert to day trading so as not to risk their winning streak. It's also the month when less-fortunate hedge funds start to see clients pull out, putting them at risk of shutting down.

September can also bring a wave of negative earnings pre-announcements from companies experiencing a summer slowdown, Cramer said.

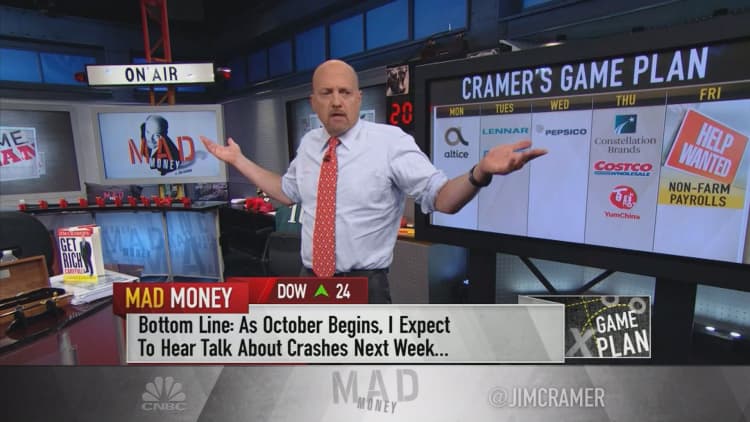

But none of those happened. So, with the market's resilience in mind, Cramer turned to the stocks and events he'll be watching in the first week of October:

Monday: Cable Controversy

On Sunday, cable customers will discover whether Optimum parent Altice and ESPN parent Disney resolved their programming dispute over Disney's sports network. If not, Disney is set to black out Altice customers' access to ESPN.

"Normally I don't care about these kinds of things, but I believe this might actually crystallize the debate about cord-cutting and the need for certain programming no matter what," Cramer said.

Cramer reiterated that he liked Disney's long-term story. The company will rise above cord-cutting concerns and continue delivering top-notch content, he said.

Tuesday: Lennar Corporation, Paychex

Lennar: Noting that 2017 has been a winning year for the homebuilders, Cramer said he expects Lennar to deliver a good earnings report despite the Florida-based company's exposure to Hurricane Irma.

As analysts raced to put out positive commentary on KB Home after a strong earnings report, Cramer couldn't help but recall the criticism he got when he pounded the table on KB in 2016.

"I got a ton of pushback, in ink, by analysts saying that I didn't know what I was talking about when it came to the homebuilders. Well, now this $14 stock has gotten to $24, and I have to ask: do the analysts who are upgrading KB Home — now, at $24 — do they know anything about homebuilding? Sure, I still like the stock, but others I like too, including Lennar," Cramer said.

Paychex: Analysts also complicated the rhetoric around this payroll processing company since its last earnings report, Cramer said. The stock rallied higher after losing some steam, but the "Mad Money" host had his reservations about Paychex's Tuesday morning earnings report.

"Be aware that these negativists are still lurking and they will try to knock it down again," he warned.

Wednesday: PepsiCo

Cramer put his faith in PepsiCo CEO Indra Nooyi to deliver a strong earnings report for her consumer packaged goods company as the rest of that industry feels increasing pressure.

"Just be aware that being the best house in a tough neighborhood, though, which it is by far, is a lot more difficult than being the worst home in a fabulous neighborhood," the "Mad Money" host said.

Thursday: Constellation Brands, Costco, Yum China

Constellation Brands: The Corona, Modelo and Pacifico owner will report earnings before the bell and Cramer expects the alcohol distributor to deliver.

But because Constellation is often the target of analyst nitpicking, Cramer suggested investors buy some shares before the report and some after in case of post-earnings weakness.

Costco: While Cramer hasn't seen much Amazon-led weakness playing out in Costco's business yet, he still worries about the voracious sellers that tend to plague this stock when it reports.

"I'd be very skeptical of it going into the quarter," he said. "You need to be able to withstand some selling pressure if you're going to own this one through the quarter."

Yum China: Up over 50 percent this year, this recent Yum Brands spin-off has been putting up strong results for the last several quarters and Cramer expects no different on Thursday.

Friday: Non-farm Payrolls

The closely watched federal government report on September job creation might have been muddled by the rougher-than-expected hurricane season, Cramer said.

Still, he expects there to be positive angles to the report, which should set the market up nicely for bank earnings the following week.

Final Thoughts

Even as geopolitical threats linger and the October crashes of 1929 and 1987 stir up uncomfortable memories, Cramer asked investors to remember September's track record.

"All I can tell you is that we had plenty of talk at the end of August about how difficult September would be and it didn't amount to a hill of beans," the "Mad Money" host said. "You pay attention to the fundamentals, not the calendar, and October could turn out to be another month like September, where you can buy stocks when they come down because of worries that may turn out to be totally overblown and unjustified given the strength of our companies, the United States and the global economy."

WATCH: Cramer sheds his September blues

Disclosure: Cramer's charitable trust owns shares of PepsiCo.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com