And the Mad Money host thinks one of the best places to find yield is in the stocks issued by real estate investment trusts or REITs.

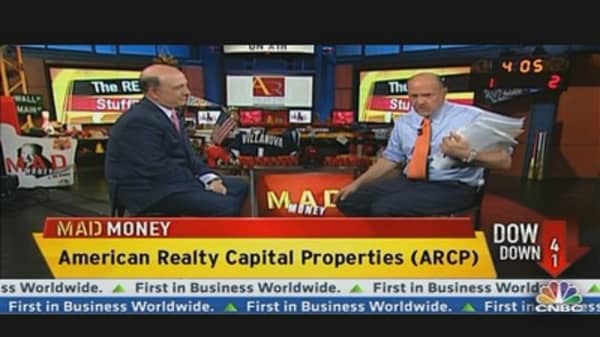

"For example you could look at American Realty Capital Properties," said Cramer. It's one of many REITs that Cramer thinks should be on your radar. "I like this stock at current levels," he said.

----------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Bearish Pattern Trouble Sign?

Street Appetite Developing for These Stocks

Investing in Future of Cancer Drugs

----------------------------------------------------------------

This company has been trying to takeover Cole Credit Property but at the time of writing, those overtures had been rejected.

On Friday's broadcast Cramer talked with Nick Schorsch, the chairman and CEO of American Realty Capital to find out more about the jilted bid and what the company may do next.

"I urge you to look at what it would mean if they can do this deal," said Cramer.

Get all the details. Watch the video above.