This op-ed originally appeared on The Jared Bernstein Blog.

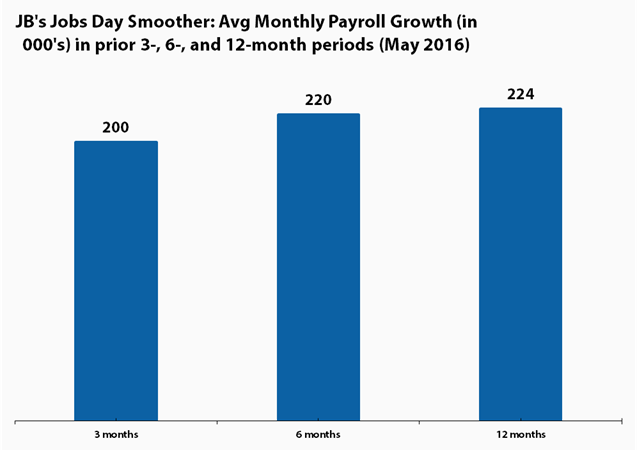

Payrolls rose 160,000 last month, less than the 200,000 we've come to expect and the smallest monthly gain since last September. Revisions to the prior two months data shaved 19,000 off of their previously reported gains.

However, though this slower pace could represent a downshift in the rate of job creation, it is far too soon to jump to that conclusion. These monthly numbers are jumpy and require averaging a few months' gains to get at the underlying trend. In fact, the monthly trend over the past three months is precisely 200,000, as shown in my monthly smoother below.