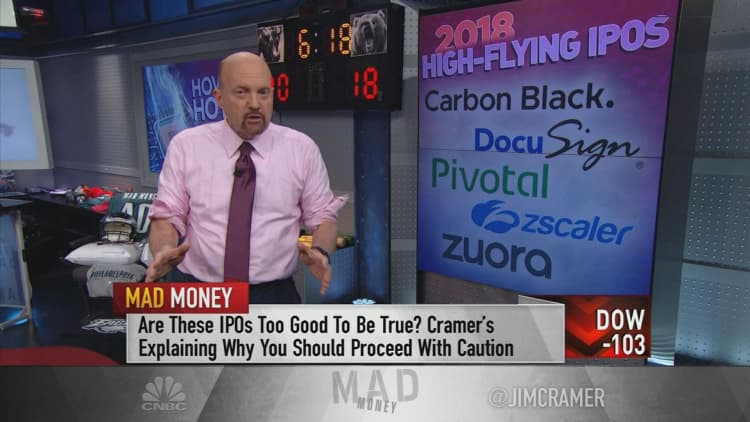

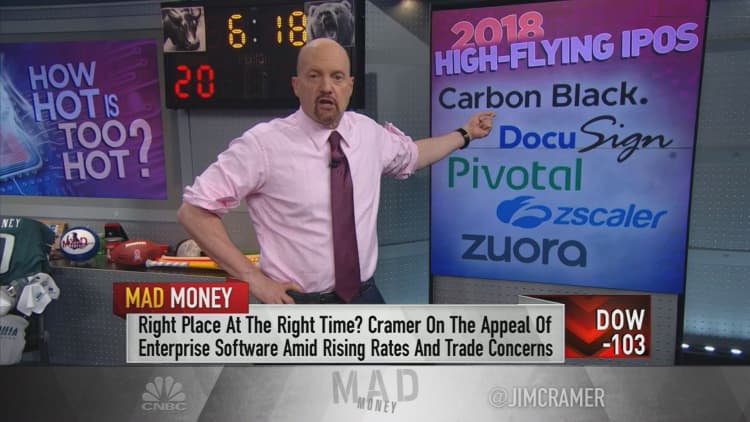

The slew of technology-focused initial public offerings this year has CNBC's Jim Cramer focused on a key question: how hot is too hot when you're invested in a red-hot IPO?

As businesses increasingly find themselves in need of enterprise-level software, a host of tech companies like DocuSign and Zuora have come public in the last few months to serious fanfare.

"But the problem with stocks that go up and then up and then up some more is that, sooner or later, they become very expensive," the "Mad Money" host warned on Monday. "So, on a decidedly subpar day for the averages, ... I think it's worth considering whether these recent software IPOs have gotten overheated."

Here are some of the hottest names:

- Carbon Black, a cybersecurity company that came public in May. Shares priced at $19, opened at $24.70 and now trade in a range of $33 to $35 a share.

- DocuSign, an electronic signature tech play that came public in late April. Shares priced at $29, opened at $38 and now trade in the $61 to $66 range.

- Pivotal Software, a cloud company whose platform helps streamline software development, came public in April. Shares started trading at $16.75 and now trade in the $27 to $31 range.

- Zscaler, a cloud security player, came public in March. Shares priced at $16, jumped to $27.50 at the start of the IPO and now trade in the low $40s.

- Zuora, which helps businesses set up subscription-service capabilities, came public in April. Shares priced at $14, opened at $20 and now trade in the $34 to $37 range.

"Those are some magnificent moves, people, and I adore many of these stories," Cramer said. "Unfortunately, though, price can matter. And up here, these recent enterprise software IPOs are looking pretty expensive."

Cramer attributed their monster runs mostly to "scarcity value." With rising interest rates and escalating trade tensions weighing on swaths of the market, investors are on the lookout for secular growth stocks that don't require a strong economy to keep climbing.

Moreover, all five companies beat analysts' expectations in their first earnings reports since coming public, ratcheting up Wall Street's expectations and sending their stocks higher still.

But "sandbagging investors with low-ball estimates is just part of the IPO process," the "Mad Money" host warned. It doesn't necessarily justify their notably high valuations, he said.

On a sales basis, Carbon Black and Pivotal Software are still somewhat reasonable, trading at nine times next year's sales, but DocuSign and Zuora trade at 13 and 14 times sales, respectively, and Zscaler sells for an "exorbitant" 20 times sales, Cramer said.

"Here's the thing: when you bet on any of these red-hot enterprise software IPOs, you're effectively betting that the companies will be able to keep beating the estimates," he told investors. "And while I like this sector a lot, ... these are, by any means, sky-high valuations. Now, that must make you more cautious."

And with investors pushing other stocks in the space like Pluralsight to almost astronomical heights — shares of Pluralsight have rallied almost 90 percent since the company's IPO last month — Cramer grew concerned that the entire group could be due for a pullback.

"I just want you to know what you own," Cramer said, noting that if any of these companies reports a less-than-ideal quarter, its stock will likely get crushed.

"If you've made a fortune in something like a Zscaler or a Pivotal Software or a DocuSign or a Carbon Black or even a Zuora, which I adore, ring the register on part of your position and swap some of that money into a cheaper, more established cloud stock like Salesforce or even Adobe," Cramer suggested. "Believe me, you'll sleep better with a little less momentum in your portfolio ... and you'll still own enough that if good things happen next quarter, you'll be thrilled."

WATCH: Cramer's warning on 2018 software IPOs

Disclosure: Cramer's charitable trust owns shares of Salesforce.com.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com