Former General Electric transportation CEO Bob Nardelli told CNBC on Tuesday he thinks there is more pain ahead for his former company.

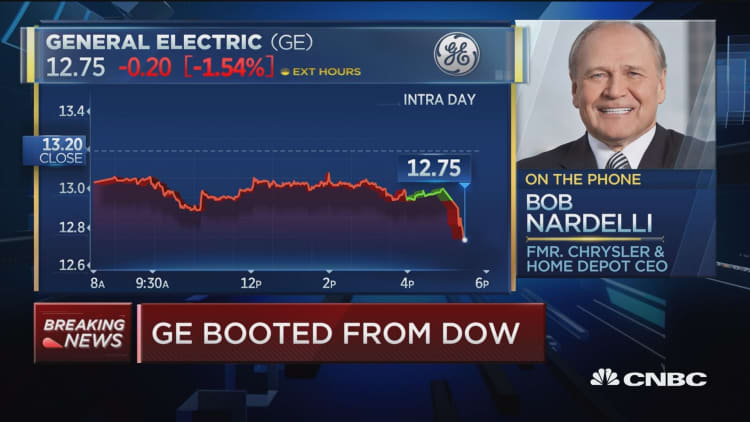

The industrial giant, which is in the middle of a massive restructuring, was booted out of the Dow Jones industrial average on Tuesday. The change will occur prior to the open on Tuesday, June 26.

Nardelli said it is a "sad day" but acknowledged GE was weighting the Dow down. It was one of the original components of the blue-chip index.

"[CEO] John Flannery has his work cut out for him. He's been there a year now, and I think time is not a friend when you're dealing with the challenges that he's facing," he said on "Fast Money."

"I don't think the worst is over," added Nardelli, who is also the former CEO of Chrysler and Home Depot.

GE was the worst performing stock in the Dow, falling more than 55 percent over the last 12 months. It lost more than 25 percent this year alone.

Flannery is trying to engineer a turnaround for the multinational conglomerate, which includes the sale or spinoff of parts of the company's portfolio.

The CEO "mentioned he's got $20 billion of assets that he has to monetize. And quite honestly, they've had a little bit of a slow start in doing that," Nardelli pointed out.

In May, GE said it was selling its transportation business to Wabtec. However, Nardelli said that won't be realized until 2019, at least from a cash-flow standpoint.

"They've got to move more quickly … monetizing non-earning assets, getting rid of some of the $20 billion worth of assets that he's identified."

Investor reaction

In the meantime, Nardelli expects shares to be hit as investors digest the latest news.

"For the average investor hearing that it was transitioned out of the Dow, they're going to react to that — that something must be worse than what's being publicized," he said.

He thinks Flannery "needs to get out there and be very positive about what he is going to do."

GE didn't immediately respond to a request for comment on Nardelli's remarks.

In a statement about the Dow move, the company said, "We are focused on executing against the plan we've laid out to improve GE's performance. Today's announcement does nothing to change those commitments or our focus in creating a stronger, simpler GE."

— CNBC's Angelica LaVito contributed to this report.

WATCH: General Electric booted from the Dow