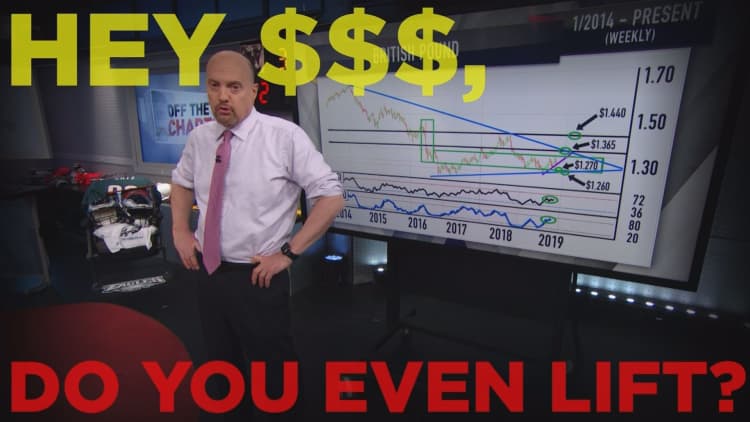

The dollar could soon peak and that would translate to a positive for portfolios, CNBC's Jim Cramer said Tuesday citing technician Carley Garner.

The "Mad Money" host took a look at Garner's interpretation of the charts that suggests the DXY US Dollar Currency Index is nearing unsustainable levels. Garner, who is the co-founder of DeCarley Trading, thinks it could soon drop because it has had a hard time breaking out over 98 since 2013, Cramer said.

The index currently stands at about 97 as of late Tuesday.

Cramer said the U.S. dollar has been climbing since hitting a bottom in January 2018 and has hurt the market. It makes exports more expensive than foreign competitors, while companies that have foreign earnings can't get the full value of their profit because the exchange rate is not in their favor, he added.

Analysts who cover U.S.-based multinational stocks would be triggered to raise numbers on various names like Procter & Gamble, Pepsico, Apple, and Google-parent Alphabet, Cramer said.

A strong currency brings many benefits, but there is a lot of harm that comes with it, the host said.

Listen to Cramer explain how a U.S. dollar peak could impact the economy here

Getting in the game

Dick's Sporting Goods "dropped the bomb" in its earnings call that has hurt a number of retail stocks as of late and investors should refrain from buying shares, Cramer said.

The sports retail giant told shareholders that it will have to invest in its online business, which grew from 19 percent to 23 percent over the past year, to fend off competition from Amazon. The expensive move to capture online shoppers is reflective of the overall market and could ruin the company's margins, Cramer said.

"That means Dick's needs to spend even more money building out its own omni-channel presence while also suffering from lower gross margins because competition from Amazon always puts pressure on your pricing," the host said.

Read more here

Equipping telecom for 5G

VMware COO Sanjay Poonen came on the show and discuss various partnerships cloud computing company has with various companies.

That includes a "very special relationship" with Amazon Web Services where his firm built compute storage and networking capabilities natively to Amazon called VMware Cloud on Amazon, he said. VMware has also teamed up with companies overseas like Vodafone and Ericsson to build cloud infrastructure for telecommunication clouds.

"VMware has now built that same type of cloud infrastructure for telco clouds so that as you move from 4G to 5G, we've become that quintessential infrastructure for that transition," Poonen said. "So our goal is to get every telco as they think about 4G to 5G, VMware is the indispensable company that can help you in that transition as cloud infrastructure."

Listen to the full interview here

Coupa Software is a cloud prince with a platform that helps businesses manage expenses. After reporting top and bottom line beats but guiding lower than expected for the year in its latest earnings Monday, the stock lost the gains it made Tuesday and finished the session down about 3 percent.

That's similar to the action other cloud stocks saw after giving good quarters, but not as drastic of a fall that Workday or Salesforce.com saw, Cramer noted.

CEO Rob Bernshteyn told the host that Coupa is streamlining virtual credit cards that can help companies better track corporate spending.

"You can go in, request the things you need, request the services you need, get a virtual credit card number right there in front of you and make the payment," Bernshteyn said. "Simple for the end user and the company still has visibility to all the spending that's happening so they can continue to optimize those categories of spend."

Catch the full interview here

Semiconductor surge

The semiconductor sector is turning the corner and showing signs that the global economy could be stronger than previously thought, Cramer said.

The industry's attempt to bounce back from its 2018 woes is being propped by Nvidia's roughly $6.8 billion cash bid for Israeli chipmaker Mellanox and Bank of America's upgrade of Apple, which could mean that the inventory glut in chips could be gone, he said.

"These days the semiconductor companies have their tentacles in everything," the host said. "These days, in the new global economy dominated by data, the semiconductor stocks punch well above their weight, just like housing."

Click here for his full insights

Cramer's lightning round: This is a speculative stock, but we recommend it

In Cramer's lightning round, the "Mad Money" host zipped through callers' questions about stock picks.

Weibo Corp.: "I'm not a fan. I'm just not a fan, what can I tell you? I just feel like it's a dice roll. I'm recommending Alibaba, that's it."

AeroVironment Inc.: "I thought it was a good quarter. There are constantly shorts in this thing. The drone business is good. A lot of the defense stocks are down. People didn't like the federal budget for the defense stocks, but I think you're fine AeroVironment, AVAV."

Invitae Corp.: "Genetic information companies. We've been recommending them for [speculative] only, but we do recommend them. We think there's a lot to like. Remember, we had Veeva on, I've heard a lot of good things. We've been listening to a lot of cloud-based companies that do stuff, including—by the way Charles River [Laboratories], it's not cloud-based but they do a lot of the technical work. I like this group."

Disclosure: Cramer's charitable trust owns shares of Salesforce.com, Amazon, Apple, and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com