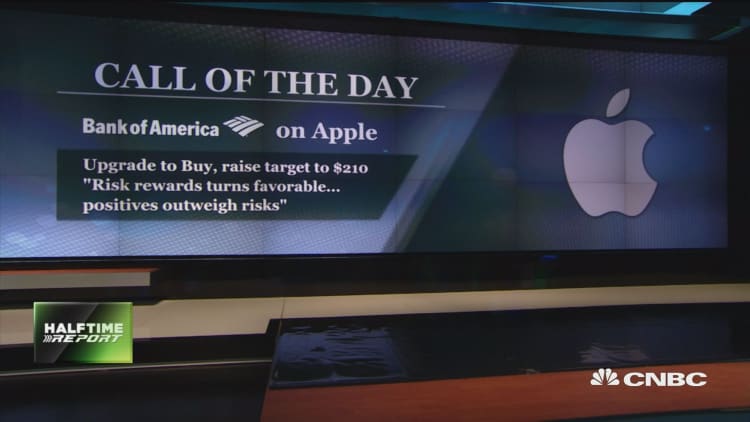

Bank of America has laid out the bull and bear cases for Apple, a day after upgrading the stock and raising the firm's price target to $210.

"Significant controversy remains over Apple's long-term trajectory. Most investors agree that Apple remains a hardware story, and while Services continue to grow double digits y/y, the majority of gross profit dollars would continue to come from hardware in the next few years," Bank of American analysts said in a note to clients published Tuesday.

The note outlines 10 points for each case, based on responses the analysts heard from investors after their big call Monday. Among the bull points: easier comps in 2019, a likely trade deal with China and the potential for a large buyback authorization in April.

Among the bear points: price pressure from cheaper competitors, underwhelming developments in the iPhone and threats to the App Store's current revenue share structure. (Apple takes a 30 percent cut from most apps and subscriptions sold through the App Store.)

Apple's stock has been on something of an upswing in recent months after a devastating fourth quarter. The shares are up 14 percent year to date, erasing some of the end-of-2018 losses when they shed 30 percent.

Apple rose roughly 1 percent in early trading Tuesday.

WATCH: Bank of America: buy Apple