For years, millennials have gotten a bad rep for buying expensive coffee, avocado toast and all things fancy. But is spending money on things that make you happy really all that bad?

Budget gurus point to the "latte factor" and argue that the key to riches is to sacrifice those everyday pleasures. Popularized by David Bach, the "latte factor" is the idea that you can save a ton of money by cutting back on small purchases and crafting budgets to curb your spending.

I think David Bach and the rest of the budgeting crew are wrong. As the CEO of the new saving platform Rize, I believe that the key to saving isn't self-sacrifice and budgeting your life down to the cent, it's paying yourself first and designing your life so that saving is simple and effortless.

Here's why.

Budgets don't work

The idea behind budgeting is that if you track and limit your spending across a mess of different categories, you'll have enough money left over at the end of the month to save. That makes intuitive sense but it rarely works for several reasons.

First, budgets are complicated and hard to stick to for any length of time. We humans are just not wired psychologically to deal with the multiple rules and constraints budgets place on us.

Second, life does not care about your carefully prepared budget. It will throw unexpected expenses your way at every opportunity.

Most importantly, we live in a world entirely designed to help you spend money; there is temptation around every corner. If you take the budgeting approach and try to save what is left after you spend, nine times out of ten there won't be anything left to save. Put simply, in a world designed for spending, spending wins.

To save more, pay yourself first

Now imagine if instead of trying to save what is left after you spend each month — paying yourself last — you flipped it around and spent only after you saved. That is the idea behind paying yourself first, and it makes all the difference.

When you pay yourself first, you treat saving like any other fixed expense that you have to pay each month, just like your rent or utility bill. You set money aside after each paycheck towards your financial goals: your upcoming vacation, your wedding, a new car, retirement, etc. Then you can spend whatever is left in your checking account completely guilt-free, knowing that you've already taken care of your future. You can have avocado toast for every meal if that's what makes you happy.

These days you can even fully automate the process of paying yourself first using a saving platform, which allows you to put saving for goals you care about completely on autopilot.

To cut back, think big

Paying yourself first is the key to keeping your spending under control and making saving a habit you have for life. But let's say you really want to kick your saving into high gear. In that case, focus on your big recurring expenses instead of your $4 lattes.

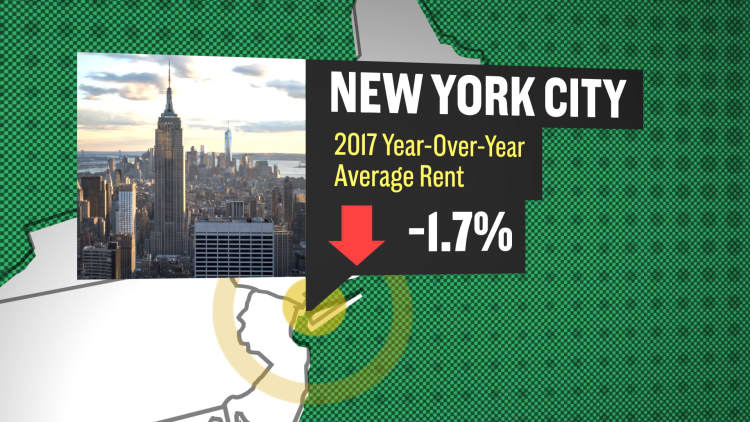

The millennial generation loves living in big cities where rent can easily consume 50 percent or more of your monthly income. If you can find a way to cut your monthly rent by moving to a cheaper location or getting a roommate, you can save hundreds of dollars every month.

The beauty of finding ways to cut back on your big, recurring expenses is that you keep saving that money every month with no additional effort, whereas if you're following the "latte factor" and trying to cut back on small things, that requires willpower every single day.

Change your thinking about spending

Instead of punishing yourself for enjoying the finer things, rethink the way you look at your latte or your avocado toast. If you're someone who really does have that latte every day and it's taking a meaningful bite out of your wallet, then try making it a reward instead of your daily routine. Get some good beans and learn to enjoy the ritual of making your coffee at home, and then treat yourself at your favorite coffee shop on Friday to celebrate the end of the week. You'll save money and might even appreciate your latte more.

At the end of the day, saving money can be easy and painless. All it takes is a little change in perspective. Automate the process of paying yourself first with a savings platform, cut back on big recurring expenses and make the things you enjoy most a treat instead of a routine. You'll make saving a habit and you'll save more than you ever thought possible.

Justin Howell is the Co-Founder and CEO of Rize, the first money app with saving and investing all in one place. Justin spent the early part of his career on Wall Street and later moved into the start-up world.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Here's how you can start having hard money conversations with your partner