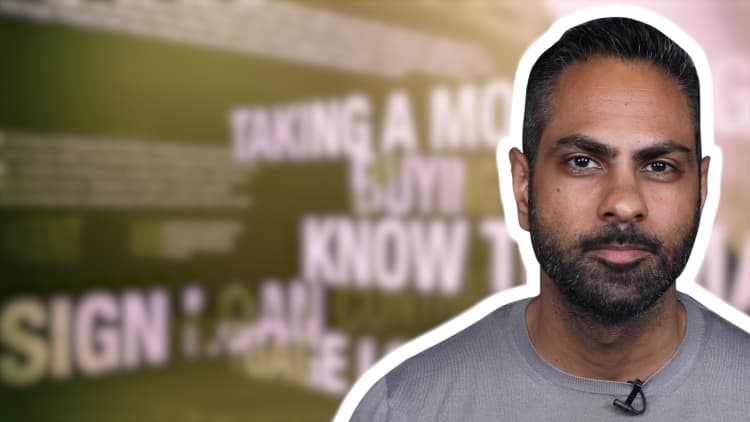

A lot of people will tell you you're wasting your money if you rent, rather than buy, a home. That may be conventional wisdom but it's just plain wrong, personal finance expert and author of "I Will Teach You to be Rich" Ramit Sethi tells CNBC Make It.

The idea that you're just throwing your money away by renting is the No. 1 myth that Sethi says he hears all the time, and it "really needs to die," so renters can stop feeling guilty about doing what's right for them.

"When I pay rent, I have a roof over my head and a great view. That's what rent gets you: shelter. It gets you a house," Sethi says.

Paying rent doesn't mean you're throwing your money away. It means you're exchanging your money for something important.

You don't have to be able to hold something tangible in your hand in order to be excited about it. When you go to a movie or buy a basket of strawberries, Sethi says, all you have to show for that purchase is the satisfaction that the film was fun or that fruit tastes good. But that's enough.

"When you spend on something you love, you get value from it," Sethi says.

In fact, depending on your situation, renting your home, as opposed to buying one, may save you money, especially if you're planning to move in the next five years.

The costs associated with a $200,000 home, including the brokers' fees, appraisal costs, title insurance, and mortgage origination fees, add up to about $2,128 on average, according to Fidelity. And if you end up paying closing costs, that could be another 5 percent.

The longer you live in the home, the more you can amortize and justify those extra expenses. But if you move around a lot, the fees can really add up.

When I pay rent, I have a roof over my head and a great view. That's what rent gets you: shelter.Ramit Sethiauthor of 'I Will Teach You To Be Rich'

Besides, it's not like you can assume your landlord is making huge profits off of you. "Your landlord can only charge you what the market will bear," Sethi says. "So sometimes landlords are making more than their expenses, but a lot of times they're not even covering their expenses."

Costs such as taxes, insurance and maintenance can add up to about 50 percent of a person's monthly mortgage, Sethi says, and those are borne by the landlord.

Ultimately, Sethi says, you can feel good about making whichever housing decision makes sense for you and your financial situation: "Paying rent is perfectly fine. Buying a house can be perfectly fine. But I want you to run the numbers before you make the biggest purchase of your life."

Don't miss: Self-made millionaire Ramit Sethi: Don't buy a house without asking yourself this question

Like this story? Subscribe to CNBC Make It on YouTube!