Today, at 69 years old, Ray Dalio is widely admired and famous for being the founder of the largest hedge fund in the world, Bridgewater Associates, which manages $160 billion. But things could have turned out very differently because of a mistake Dalio made when he was a young entrepreneur.

During a Reddit "ask me anything" on Tuesday, Dalio, who is now worth more than $18 billion, was asked what he might tell his younger self.

"The big message I would want to have given myself is 'Why are you so stupidly arrogant!?!'" Dalio wrote on Reddit.

That's because in 1982 when Dalio was 33, he almost ran Bridgewater into the ground.

Dalio says he was convinced the global economy was going to go into a depression and was too arrogant and overconfident to do the appropriate historical research, so he traded his stocks accordingly.

"I was dead wrong … The stock market began a big bull run, and over the next eighteen years the U.S. economy enjoyed the greatest noninflationary growth period in its history," he wrote in his book "Principles: Life and Work."

Dalio lost so much money he had to let go of his employees and borrow $4,000 from his father just to get by.

"My experience over this period was like a series of blows to the head with a baseball bat. Being so wrong — and especially so publicly wrong — was incredibly humbling and cost me just about everything I had built at Bridgewater."

Had a great conversation on my reddit AMA today.

The experience taught Dalio to question his own assumptions and seek out independent thinkers to challenge him for better outcomes.

So with hindsight and some hard-won wisdom, Dalio would have told his younger self, "you can be worlds smarter and raise your chances of making better decisions if you could simply be humble and worried enough about being wrong to have the smartest people who are willing to disagree with you and challenge you so that you could examine their reasoning," Dalio wrote on Reddit.

Dalio now operates his hedge fund on the principal of an "idea meritocracy," a "decision-making system where the best ideas win out," the financier wrote on LinkedIn in 2017, to which he attributes, at least in part, Bridgewater's success.

"The biggest tragedy of most people is that they think that the right decisions are in their heads, they have opinions that they are attached to and that I learned through experiences, I learned humility," Dalio said on the Recode Decode podcast in 2017.

"[Bridgewater's] culture, this idea-meritocratic culture has been mind-blowingly effective," Dalio said. "No human being has anywhere near the capacity to make the great decisions as great collective decision-making."

See also:

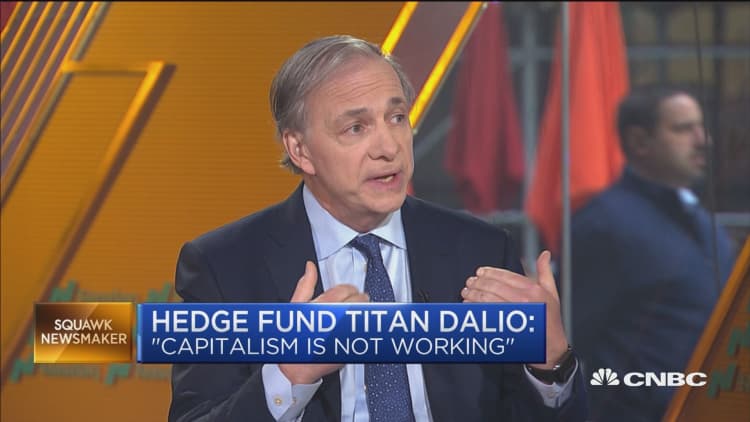

Hedge fund billionaire Ray Dalio: 'Capitalism basically is not working for the majority of people'

Billionaire Ray Dalio: You will 'inevitably succeed' if you follow these 5 steps

Like this story? Subscribe to CNBC Make It on YouTube!