If you already have a fully-funded emergency fund and make regular contributions to a retirement account like a 401(k), you're way ahead of the curve.

Only about half of American families are participating in some way in the stock market, according to research from the St. Louis Fed. When it comes to millennials (ages 23 to 38), about 60% have no direct or indirect exposure to the stock market.

Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. That way, if you run into any issues, you have money on hand, rather than needing to cash out your investments or being forced to pay a penalty to access money saved in a retirement account.

Experts also urge people to regularly contribute 15% of their income to retirement accounts, or at minimum, enough to meet any employer match.

But if you've checked both those boxes and you still have some money left over at the end of the month (beyond what you spend on your fixed expenses), it can be tricky to determine what to do with it.

Make no mistake, it's a good problem to have.

Understand why you're investing

Take some time to assess your finances and your goals. Do you have any debts to pay off? If so, focus on those before setting up another investment account. You don't have to be completely debt-free, but you should have a responsible plan in place to take care of those commitments over time.

If you are debt-free or are already working toward paying down your balances, focus on your upcoming goals. Do you want to buy a house? Start a family? Build your own business? Add extra cushion to your retirement? Also look at when you'd like to accomplish your goals.

"Time horizon is the determining factor here," Ron Guay, a financial planner with California-based Rivermark Wealth Management, tells CNBC Make It. Why you want to invest does have an impact on how you should invest. If you have a short term goal — such as buying a home in the next three years, for example — experts say you should look for a more conservative investment such as bonds, or even keep the money in a high-yield savings account.

Most people should start with a Roth IRA

If your goal is retirement or long-term wealth accumulation, Guay recommends stashing any extra savings in a Roth IRA, which is a tax-free investment account. Unlike 401(k) contributions, any money you add to a Roth is added after taxes are taken out of your paycheck. But the money is allowed to grow, and you don't have to pay income or capital gains taxes if you make withdrawals correctly.

Morningstar's director of personal finance, Christine Benz, also recommends investing in a Roth IRA before opening a brokerage account. "Investing in something that gives you a tax break will almost always be preferable to investing inside a taxable account," she tells CNBC Make It.

"I think of a taxable account as something to explore after you have funded your 401(k) and your IRA," Benz adds, saying that a brokerage account is best suited when you need greater access to your money and for goals that may have a shorter time horizon than the 30 to 40 years most millennials have until retirement.

Investing in something that gives you a tax break will almost always be preferable to investing inside a taxable account.Christine BenzMorningstar's director of personal finance

Roth IRAs also offer investors a lot of flexibility, experts say. One of the beauties of the Roth, Guay says, is that you can withdraw any money you've put into the IRA at any time without taxes or penalties. And after your account has been open at least five years (or you've reached the age 59½), you can withdrawal any investment earnings without incurring the typical 10% penalty.

Plus, most Americans are facing a retirement shortfall. Progressive think tank the Economic Policy Institute found that Americans 56 to 61 had a median balance of $21,000 in their 401(k) accounts in 2016, which is the most up-to-date data on file. That total reflects almost 30 years of savings.

Younger generations do not fare much better. Older millennials (ages 32 to 37) have about $1,000 saved in their 401(k)s. So putting more dollars toward your retirement is almost never a bad idea.

When a brokerage account makes sense

Roth IRAs can be great, but there are some restrictions to be aware of when investing in these accounts.

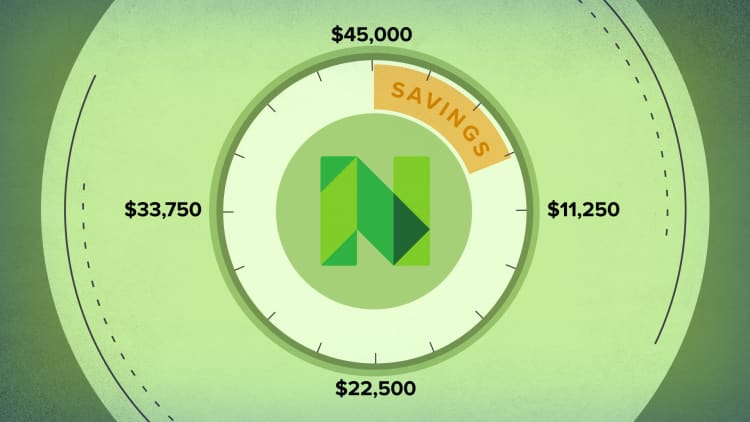

First, there's a limit to how much you can invest: In 2020, you can put away $6,000 in a Roth IRA and allow it to grow tax-free. Second, you can only make full contributions to these accounts if your individual modified adjusted gross income is less than $124,000 this year ($193,000 for those who are married and filing jointly).

Additionally, because of the contribution limits, you can't accumulate a huge nest egg overnight, and any returns are tied up for at least five years. That can be an issue if you're saving up for a purchase you want to make in less than five years — such as buying a car, putting a down payment on a house, throwing a big wedding or planning a bucket-list international vacation.

For most investors, ultimately having a mix of taxable, tax-deferred, and tax-free accounts gives them the most flexibility for whatever the future brings.John Crumrinefinancial planner

If you're saving up for a purchase you're planning to make in less than five years, or you make too much to contribute to a Roth IRA, then consider using a taxable brokerage account to put your money to work in some low-risk investments to avoid paying any penalties. Another option is to open a high-yield savings account.

Of course, you could invest in both places and have the high-yield savings account on top of your emergency savings account. Any of the big brokerages including Fidelity, Schwab and Vanguard allow customers to set up a Roth IRA account and a taxable account at the same time, John Crumrine, a CFP and founder of North Carolina-based Brunswick Financial tells CNBC Make It.

"Getting these established is sometimes the biggest hurdle for new investors," he says. But once the accounts are opened, you can set up an automatic transfer so that you split your monthly contributions between the two accounts.

"For most investors, ultimately having a mix of taxable, tax-deferred, and tax-free accounts gives them the most flexibility for whatever the future brings," Crumrine says.

Don't miss: Here's how to finally start investing in 2020

Like this story? Subscribe to CNBC Make It on YouTube!