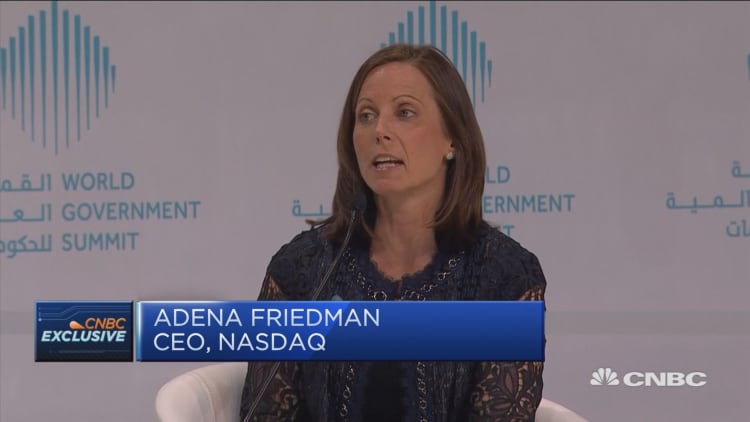

The frenzied market sell-off last week was driven by human emotion and not algorithm-based trading, according to the CEO of the Nasdaq.

"The foundation of the market movements we have seen over the last several days has been through human emotion," Adena Friedman told CNBC at the World Government Summit in Dubai on Monday.

At their lows, all three major U.S. indexes slumped into correction territory last week after hitting record highs in January. Financial analysts have long warned that the rocketing bull market would at some point come to a screeching correction thanks to its highly overvalued stock prices. It appears last week was the first sign of that, though experts are divided over whether the market will sink further.

Meanwhile, as more and more transactions are made through algorithm trading — also known as algo trading — some strategists have argued that the sell-off could have been prompted by technical mechanisms.

When asked whether it was safe to say humans — and not algorithms — were still in control of market, Friedman replied: "I think humans are definitely in charge of the decisions in the market. I think that the way that the algorithms are written is basically on the back of a human decision."

To the contrary, said influential banking analyst Dick Bove. "The United States equity markets has been captured by out-of-control technological investment systems," he says in a commentary Monday on CNBC.com.

'Welcome correction'

Friedman said strong U.S. economic data in recent weeks had created a "common view" among investors that the Federal Reserve would soon increase interest rates at a faster pace than previously expected.

The Dow Jones industrial average and the S&P 500 lost 5.2 percent on the week, while the Nasdaq shed 5.1 percent as rising interest rates spooked investors. The Dow experienced two drops of more than 1,000 points and two gains of more than 300 points during the volatile week.

Elsewhere, International Monetary Fund Director Christine Lagarde said the sell-off was not something to worry about. In fact, Lagarde said the view of the Washington-based IMF was that last week's losses were a "welcome correction."

— CNBC's Natasha Turak and Thomas Franck contributed to this report.