Thinking about prepaying some of your 2018 taxes in advance of limitations imposed by the Republican tax plan?

Well, forget about it.

The final version of the tax legislation includes a provision that would disallow a deduction in 2017 for any prepayment of 2018 state and local income taxes (otherwise known as SALT). Forbidding prepayment means taxpayers cannot take advantage of the current tax law, which is more generous.

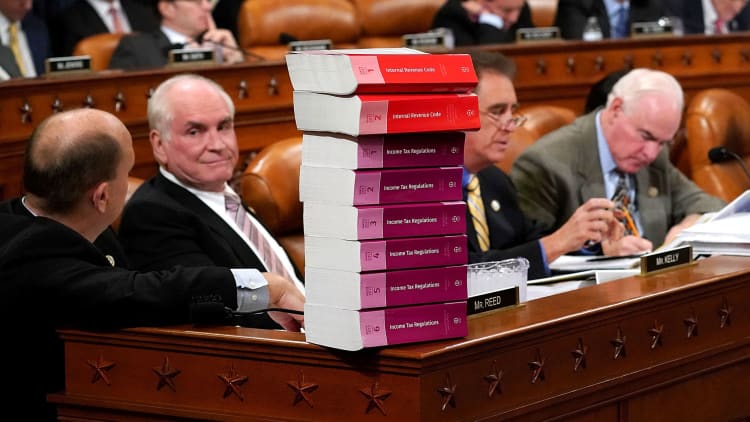

Currently, taxpayers who itemize can deduct those expenses — which can be burdensome in high-tax states — on their federal tax return. The GOP bill imposes a $10,000 deduction cap on the combined value of SALT and property taxes beginning in tax year 2018.

The tax-overhaul bill will likely be voted on this week in both the House and Senate. If both chambers pass the final version, the measure will head to President Donald Trump for his signature.

While the $10,000 deduction cap for combined SALT and property taxes is one of the few tax breaks for individual taxpayers retained in the bill, it's important to remember it's only available to those who itemize. And for itemizing to make financial sense, the value of all your deductions need to exceed the standard deduction.

Under the bill, the standard deduction would nearly double for all taxpayers before returning to current law in 2026. This means starting next year, an individual would need total deductions to exceed $12,000, the tax bill's new standard deduction for individual taxpayers, up from the current $6,350.

Married couples filing jointly would need deductions worth more than their new standard deduction of $24,000 under the bill, which is up from $12,700 for 2017; for heads of households, it's $18,000, up from $9,350 this year.

About 49 million taxpayers, or 28 percent, currently itemize, according to the Urban-Brookings Tax Policy Center. If the bill is approved, it's likely even fewer taxpayers would do so.

More from CNBC Personal Finance:

GOP tax bill expands medical expense deduction for two years

Find your new tax brackets under the final GOP tax plan

Final tax plan leaves popular stock sale strategies untouched

(Correction: A previous version of this story incorrectly stated that property taxes could not be prepaid.)