It can be tempting to put retirement on the back burner.

Between fixed monthly costs, student loans and other savings goals such as a home or car, it can seem impossible to also make room in the budget for retirement contributions. But the longer you put off planning for your golden years, the farther behind you'll fall.

The good news is, there are ways to start building your nest egg without feeling cash strapped or making any drastic lifestyle changes. Here are six effective strategies.

Start young

Time is on your side when you're young. The sooner you start putting your money to work, the less you'll have to save each month to reach your goals, thanks to the power of compound interest.

If you start at age 23, for instance, you only have to save about $14 a day to be a millionaire by age 67. That's assuming a six percent average annual investment return. If you start at age 35, on the other hand, you'd have to set aside $30 a day to reach seven figure status by age 67.

Set up automatic contributions

If you automate your retirement savings — meaning, you have a portion of your paycheck sent directly to a retirement account, such as a 401(k), Roth IRA or traditional IRA — you'll never even see the money you're setting aside and will learn to live without it.

Ideally, you'll want to work your way up to setting aside at least 10 percent of your pretax income, but if you're only comfortable with setting aside one percent, start there!

Bonus: Check online to see if you can set up "auto-increase," which allows you to choose the percentage you want to increase your contributions by and how often. This way, you won't forget to up your contributions, or talk yourself out of setting aside a larger chunk when the time comes.

If you can't find the feature online, call your retirement plan provider to find out if what's possible.

Take advantage of your company match

If your company offers a 401(k) match, take full advantage of it. It's essentially free money.

The way it works is, your company will match whatever contribution you put towards your 401(k) up to a certain amount. For example, if you choose to put four percent of your salary into your account, your employer will put that same amount in as well, in effect doubling your contribution.

But you only get their money if you put yours in first.

Bank any surplus money

Whenever you come across any extra cash — a bonus, birthday check or small windfall — rather than blowing it on a new pair of shoes or vacation, send at least a chunk of it straight to savings.

To resist the temptation to spend any surplus money, deposit it right away, so you never even see it.

Invest your spare change

Besides putting money in a tax-advantaged retirement account, you can also open an investment account to help fund your future. And thanks to micro-investing apps such as Acorns, you only need "spare change" to get started.

The app will round up your purchases to the nearest dollar and automatically put your coins to work. Other apps also aim to make investing simple and accessible, and automated investing services known as robo-advisors can help you out, no matter how much you have in the bank.

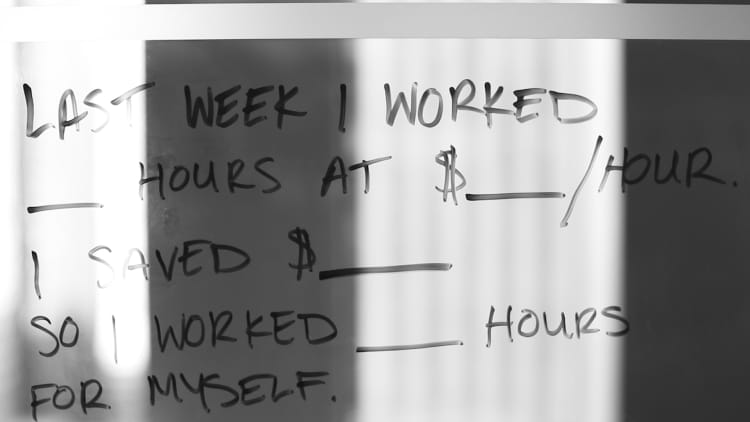

Increase your income

If you want to set aside more for retirement, a simple solution is to increase your income, which could mean picking up a part-time job or starting a side hustle.

Check out six ways to make money without much effort.

Don't miss: Here's how much the average young family has saved for retirement