It was hard to look anywhere on social media this summer without seeing someone grasping a can of the sparkling, sparsely flavored, adult beverage sensation called White Claw.

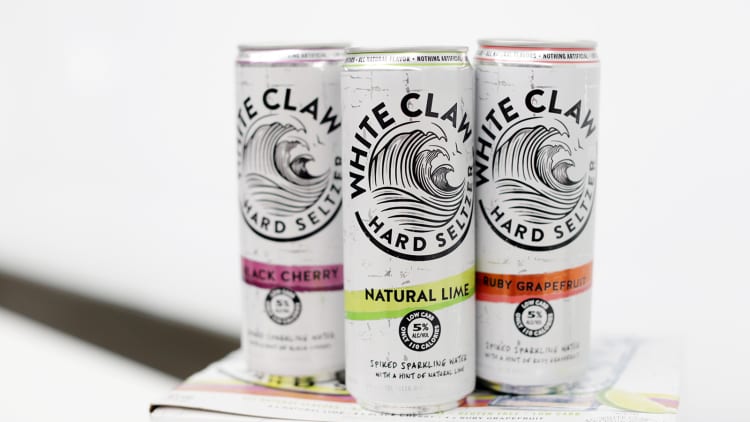

The best-selling hard seltzer on the market, which comes in flavors like black cherry and ruby grapefruit, exploded onto the drinking scene like a freshly-shaken carbonated beverage during the warmer months of 2019, a period dubbed "White Claw Summer."

In fact, this summer saw such a popularity spike for the spiked seltzer that the brand, which was first launched by Mike's Hard Lemonade manufacturer Mark Anthony Brands in 2016, declared a nationwide shortage of White Claw in September amid increased demand that White Claw said was outpacing supply.

Sales of White Claw are up roughly 250% in 2019 compared to the previous year, according to data from Nielsen, with the brand saying in October that White Claw had already seen retail sales of $638 million this year, and the brand now says it can top $1.5 billion in sales by the end of 2019.

"The momentum continues to build," Sanjiv Gajiwala, White Claw's senior vice president of marketing, tells CNBC Make It

Those numbers represent a large chunk of overall hard seltzer sales, a market segment that's tripled over the past year-long period (ending Nov. 2), growing more than 202% from the previous year to top $1.3 billion, according to Nielsen.

Rival brands such as Truly, owned by Sam Adams brewer Boston Beer Company, and Anheuser-Busch's Bon & Viv — which was announced as the official hard seltzer sponsor of the NFL in August — have also seen surging sales this year, riding the same sparkling wave of hard seltzer popularity as White Claw.

Meanwhile, the increasing popularity of hard seltzers also has more and more giant companies looking to jump into the market. The MillerCoors-owned Henry's Hard Soda brand rolled out a line of flavored Hard Sparkling drinks in 2017.

And, in addition to selling Bon & Viv Spiked Seltzer, beer giant Anheuser-Busch is moving on the hard seltzer crowd with a full head of steam, as its Budweiser brand officially announced a line of Bud Light Seltzer in various flavors (like Strawberry and Mango) in November. That announcement came about three months after another big Anheuser beer brand, Natural Light, unveiled its own of alcoholic seltzers in flavors like "Catalina Lime Mixer."

Anheuser-Busch had seen success with its Bon & Viv brand, and the huge upswing of interest in hard seltzer this past summer convinced the company to look for other ways to tap into the hard seltzer market with their existing brands like Natural Light and Budweiser, Ricardo Marques, vice president of marketing for core and value brands at Anheuser-Busch, tells CNBC Make It.

"We saw a tremendous opportunity to bring our Natural Light brand to disrupt and to challenge and help build this very interesting segment in the beverage industry," Marques says.

The growing influx of beer brands into the seltzer space might suggest that adult beverage makers might be worried about hard seltzer eclipsing the popularity of beer. Overall, though, hard seltzer sales still only represent around a 2.8% share of the total market for beers, alcoholic ciders and flavored malt beverages (the latter of which includes drinks like White Claw, which is brewed, and taxed, like beer), according to Nielsen.

That being said, Danelle Kosmal, vice president of Nielsen's beverage alcohol practice, tells CNBC Make It that hard seltzer's share of the market spiked to roughly 5% over the summer, and the beverage's surge is helping to spur growth overall in what would otherwise be an "essentially flat" beer category this year.

Why seltzer?

So, what's behind the hard seltzer craze, both among consumers and brand executives? As with many other food and beverage trends — from nondairy milk to plant-based meats — the increase in the number of health conscious consumers seems to be a primary driver for the rising interest in hard seltzer.

A 12-ounce can of either White Claw, Truly or Bon & Viv comes in at 100 calories, or less — which is less than most beers, and even less or comparable to most light beers (Miller Lite clocks in at 96 calories per 12 ounces, while Bud Light is 110 calories). The hard seltzers also boast fewer carbohydrates, with each of those three leading brands coming with two grams of carbs. A 12-ounce serving of Bud Light has 6.6 grams of carbs, while Coors Light has five grams and Miller Lite is among the lightest options at 3.2 grams.

What's more, even though White Claw is brewed with fermented sugars, the drink is still far from carrying a heavy sugar load when compared to other hypersweet beer alternatives on the market, including Mike's Hard Lemonade (32 grams of sugar per bottle) or Smirnoff Ice (33 grams). Truly features one gram of sugar, verus two grams for White Claw and zero for Bon & Viv.

Meanwhile, most hard seltzers range between 4% and 6% of alcohol content, which also makes them comparable to drinking a can or bottle of beer as far as drinkers are concerned.

"Many hard seltzers are low-carb, low-sugar — and they're doing a really fantastic job at communicating that to consumers," says Nielsen's Kosmal. Hard seltzers can also provide a gluten-free alternative to traditional beers brewed with barley and wheat that contain gluten.

Riding the (non-alcoholic) seltzer wave

Of course, the rise of hard seltzers in the beer category is also just a reflection of the broader surge in popularity of non-alcoholic flavored seltzers evidenced by the sudden and massive popularity of brands like LaCroix and Spindrift, while beverage giants have flooded the seltzer market with their own new flavored seltzer brands in recent years, from PepsiCo's Bubly to Coca-Cola's new caffeinated AHA brand.

Seltzers have been a popular drink choice for consumers looking to lead a healthier lifestyle since the 1980s, according to Barry Joseph, the author of "Seltzertopia," a 2018 book chronicling the history of seltzer. But the trend really started gaining more traction in the popular conscience in recent years with the explosion of interest in brands like LaCroix from millennials and on social media, Joseph tells CNBC Make It.

"A few years ago is when people started really pushing flavored seltzers in a new way and found new ways to market them to millennials and using tools like social media to find new audiences and new markets," Joseph says. "In many ways, it was redefining what seltzer meant for a new generation...."

Now, just like LaCroix and other nonalcoholic seltzer brands found an eager consumer base waiting for more soda alternatives (U.S. soda sales have dipped in recent years, while seltzer sales grow at a double-digit rate annually, according to Nielsen), hard seltzers are tapping into the beer market on account of consumers looking for healthier alcoholic options.

And while Nielsen's Kosmal contends that hard seltzer is being enjoyed by drinkers of all ages, "we do tend to see it and hear a lot more from millennials and the legal drinking age Gen Z-ers that it's more important for them," she says.

That's certainly the age demographic that Anheuser Busch was looking to target, first with its Natural Light hard seltzer (which has sold over 480,000 cases since launching in August) and later the Bud Light version. Anheuser Busch's Marques tells CNBC Make It that Natural Light was already a brand with "a ton of affinity with a millennial drinker that is at the eye of the hurricane of the seltzer movement."

The target demographic for Natural Light Seltzer is between the ages of 21 and 29, the brand tells CNBC Make It.

In the case of White Claw, the brand's reputation for being popular with younger drinkers, especially millennials, definitely received a boost from a particularly strong social media presence that's spawned widespread internet memes and a parody video that's garnered over 3.2 million views on YouTube since June.

White Claw's Gajiwala credits the brand's more recent explosion, particularly online, in part to the fact that the company ramped up distribution of White Claw to more retailers this year. The brand then caught on at social media friendly events like the Kentucky Derby in May, where White Claw was a sponsor, and at April's Coachella music festival, where the drink was dubbed a "rising star" by The Wrap.

By the middle of the summer, even Gajiwala was taken aback by how popular White Claw had become. One weekend in mid-July, he says he was spending time with his in-laws when his phone kept blowing up with messages from friends and family sending him popular White Claw memes. "It felt like everyone was talking about the brand at one time, which was crazy to see and so exciting to have, like, my friends and people I hadn't talked to in years send notes," he says.

Hard seltzer's 'mass appeal'

White Claw is also geared toward younger drinkers, but the company also aims to agnostic when it comes to gender. While, in the past, beer alternatives like Smirnoff Ice — and, in the early 1990s, brands like Zima — have suffered from the stigma of being drinks that mostly women would prefer, rather than men.

However, White Claw's customers are fairly evenly split between women (53%) and men (47%), the company says.

That mass appeal is part of the reason why Kosmal believes that hard seltzer is more than just a fad, like some briefly popular beer alternatives from the past (like Zima) that later flamed out.

"I think that it isn't like a situation of Zima where it was one brand that was kind of defining that segment," she says. "There are a lot of brands that are defining hard seltzers, and as more and more brands continue to enter the market, I think it's going to help to diversify that conversation a little bit more."

As Eater wrote in August: "It's an upscale, aspirational brand, one that doesn't carry the same trashy, low-budget connotations as other malt liquor beverages like wine coolers," though they are indeed a malt liquor beverage.

But hard seltzers will still have to prove that they can maintain the segment's strong growth now that "White Claw Summer" is in the rearview mirror. After all, even with the rapid growth of the hard seltzer market in the past couple of years, sales of hard seltzer still only account for small fraction of the overall beer/cider/flavored malt beverage-market, according to Nielsen.

Kosmal expects that market share to continue growing, though, as Nielsen's research has shown that people who try hard seltzer once are more likely to become repeat customers than they might with other alcoholic beverages.

"What we saw was that hard seltzer was experiencing higher than average repeat rates," she tells CNBC Make It. "And that wasn't for any particular brand, it was for hard seltzers in general. And so with those strong repeat rates, I think that tends to be a strong indicator that there's some longevity to it."

The fact that major beer brands like MillerCoors and Anheuser-Busch are going full steam into the hard seltzer market is an obvious sign that the entire industry believes that consumers aren't looking to put down their cans of alcoholic seltzer anytime soon. But can smaller upstarts like White Claw stay at the top of the hard seltzer market for long with behemoths like Budweiser in hot pursuit?

The answer could come from the non-alcoholic market, where after enjoying their time in the millennial spotlight, upstart brands like LaCroix have more recently seen their sales start to flag as larger beverage companies like PepsiCo and Coca-Cola stake out their spots in the market.

As far as White Claw's Gajiwala is concerned, his brand and the rest of the hard seltzers on the market only have room to grow.

"Only 6% of households in America have purchased a White Claw," Gajiwala says, before also pointing out that somewhere around 70% of households buy beer. "There's a huge amount of upside for us and a ton of opportunity to penetrate new consumers."

— Additional reporting by Claire Nolan.

Don't Miss:

This booze company wants to pay you $60,000 to travel across America and pursue your passion

Like this story? Subscribe to CNBC Make It on YouTube!