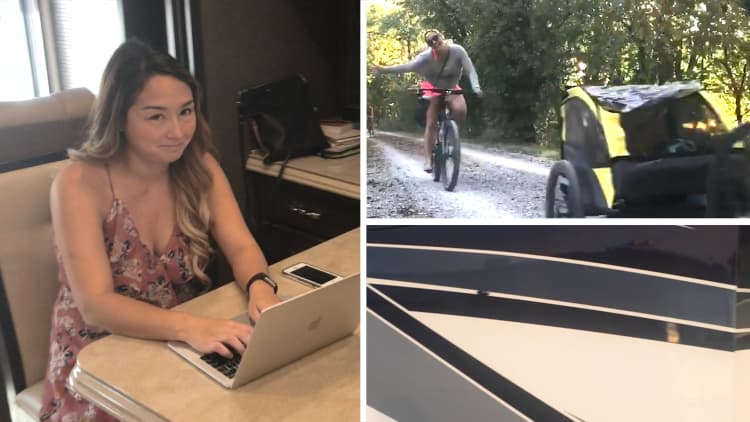

In 2013, after paying off her student loans, Michelle Schroeder-Gardner and her husband Wes quit their day jobs to blog and travel full-time.

At the time, their site was generating about $10,000 a month. Today, it regularly earns them over $100,000 a month.

Despite their financial success, the two still live modestly, choosing to save and invest about 85 percent of their income.

"We are more frugal and saving more money than ever," Schroeder-Gardner writes on "Making Sense of Cents." Here are four of their top money-saving strategies:

Think about an item's value before buying it

It's tempting to try to save money by buying the cheapest version of an item, but inexpensive products can end up costing you in the long run.

"Buying the same item over and over again because you only buy cheap products may mean that you are spending more money over time because of having to replace it so often," writes Schroeder-Gardner.

Invest in things that have value. That advice doesn't just apply to big purchases, either. Check out 18 things worth paying extra for, which range from a coffee maker to a well-made suit.

Downsize

A simple way to lower your fixed costs is to downsize, especially if you have extra living space.

"If you're not using the extra rooms, then what's the point of having them anyways?" Schroeder-Gardner writes. "Downsizing may mean a cheaper home, less money spent on utility bills, less money spent on furniture and a better use of space."

Cut back on expensive habits

How much do you spend on fast food? Soda? Alcohol?

"Sure, all of this can be fine in small quantities," notes Schroeder-Gardner, but if you've made a habit out of feeding yourself from the bodega around the corner or racking up excessive bar tabs, purchases can add up.

The more food you can prepare at home, the better off your food budget, and your health, will be.

To still enjoy nights out without breaking the bank, consider using CNBC reporter Emmie Martin's strategy, which saves her $300 a month: Either order alcohol or food, but not both. "If I choose to go out to dinner, I skip the wine," she says. "If I head to the bar, I commit to cooking dinner myself when I get home."

Find frugal entertainment

The best savers find joy in things that don't cost much, such as hiking, reading, hosting a potluck or taking advantage of free activities offered by your city or town.

"We used to spend too much money on entertainment," writes Schroeder-Gardner. "Now, we invest money in items that we know will bring fun for years to come."

For them, that means investing in things like bikes and camping gear: "Even though the upfront cost is high, we will be able enjoy these items without spending much more money well into the future."

Like this story? Like CNBC Make It on Facebook!

Don't miss: 28-year-old who paid off $38,000 in 7 months: This is the first step to take to pay down debt