Across the U.S., rent rose an average of 2.5 percent to a $1,359 per month in 2017, reports RENTCafé, citing data from the real estate intelligence source Yardi Matrix. That marks a steady 24 percent rise from 10 years before, when the national average was $1,093 a month.

In some cities, average rent rose less than 2.5 percent, however, and, in some cases, prices actually fell.

Big cities that saw significant increases include San Diego (5.5 percent), Detroit (5.6 percent) and Las Vegas (6.3 percent). Sacramento, California, grew the most of the mid-size cities at 8.8 percent, while Odessa, Texas, which rose over 33 percent, grew the most among the smaller ones.

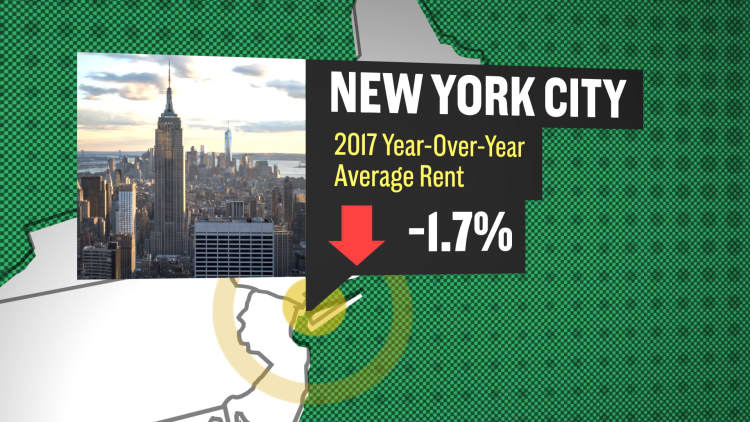

In many of the hottest markets, growth was sluggish or reversed course compared to the national average: Manhattan and Brooklyn were 2017's top two slowest growing markets in terms of price, for example, while Las Vegas and Detroit were the top two fastest growing. That's because, as RENTCafé reports, when a city becomes too overpriced, it is "due for a correction."

So in Manhattan and Brooklyn, rent actually dropped 1.7 percent — though the average rent in Manhattan is still the highest in the nation, at $4,079 a month. And renters in trendy Portland, Oregon, paid an average of 1.2 percent less than they had in 2016.

Still, those respites aren't country-wide. The second highest average rent in the nation can be found in San Francisco: $3,430 a month and climbing, up 1.5 percent from the year before. It's expensive enough that lawyers from one firm commute in to work from Houston on a $3 million jet and still save money.

And in Boston, with the country's third highest average, rent rose 2.1 percent to $3,248.

The data collected for this analysis by Yardi Matrix consists of actual rents charged, as opposed to asking prices, in apartment communities with at least 50 units.

The averages account for different types of units. One-bedrooms actually increased in cost the most (3.1 percent), hitting an average of $1,223, whereas studios only rose to $1,256 (2.2 percent). Two-bedrooms rose to $1,405 a month (3 percent) and three-bedrooms rose to $1,640 a month (2.9 percent).

Data for all 250 cities surveyed can be found here.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Credit card debt hits record high of over $1 trillion—but one trick can save you thousands

Video by Beatriz Bajuelos Castillo and Bryce Churchill