Using a 401(k) plan to save for retirement is an attractive option: You get tax advantages, the funds are automatically taken out of your paycheck for you and sometimes your company even matches your contribution up to a certain amount, which is essentially free money.

Unfortunately, many Americans don't have access to this specific retirement tool.

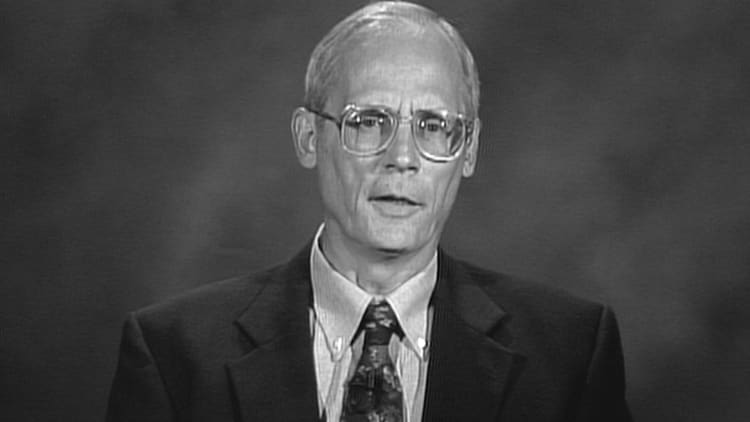

If that's the case for you, don't stress. And don't use it as an excuse to put off saving for retirement. "I hear a lot of people say, 'I can't save for retirement because I don't have a 401(k). I'm screwed from the beginning,'" certified financial planner at Betterment Nick Holeman tells CNBC Make It. "But that's not the case. There are a lot of other account types out there."

Plus, "saving for retirement doesn't really depend on the account type that you use," he adds. "The most important thing is just for you to start saving early and often."

If you're self-employed, a freelancer or your company doesn't offer a 401(k) plan, here are other smart ways to build your nest egg:

Fund a traditional IRA

An IRA, short for individual retirement account, is designed specifically for retirement. There are multiple types, including a traditional IRA.

Like a 401(k) plan, IRAs offer tax breaks. "With a traditional IRA, you contribute pre-tax dollars and let that money grow tax-deferred over time," Holeman tells CNBC Make It. "You'll pay taxes on your contributions and investment gains only when you withdraw the money, which you can do starting at age 59 ½. If you withdraw before then, you'll have to pay a penalty fee."

You can contribute up to $5,500 a year, or $6,500 if you're 50 or older.

Fund a Roth IRA

With a Roth IRA, contributions are taxed when they're made, so you can withdraw the contributions and earnings tax-free once you reach age 59 ½.

There's an income cap on the Roth IRA, which the IRS sets each year based on modified adjusted gross income (MAGI): This year, a single person with a MAGI of $135,000 or more and a married couple making more than $199,000 cannot directly contribute to a Roth.

Like a traditional IRA, there's also a contribution limit: $5,500 a year, or $6,500 for people age 50 or older.

Fund a SEP IRA

A SEP IRA, or simplified employee pension IRA, is a type of traditional IRA for self-employed individuals, including anyone with freelance income, or small business owners. It's "a very simple way to recreate a type of employer retirement account similar to a 401(k)," says Holeman. "But there's a lot less paperwork, so they can be a lot lower cost."

Plus, you can contribute a lot more money: "The typical rule is, if you're self-employed, you can contribute about 20 percent of your net income, up to $55,000 in 2018. And you can do that in addition to contributing to a traditional or a Roth IRA, so it's a good way to double dip. Of course, you have to afford to save that much in the first place, but if you can, it's a great way to get some extra tax benefits."

As with a traditional IRA, your contributions are not taxable until you withdraw the money.

Note that if you're a small business owner with employees and open up a SEP IRA, "you have to also contribute money into your employees accounts," says Holeman. "So if you're self-employed, all the money is going to you. If you have some employees, know that some of the money is going to them as well."

While a SEP IRA is a good option, if you're not contributing more than $5,500 a year to your retirement fund, stick with a traditional or Roth IRA, Holeman advises: "Those have even less paperwork and are very easy to use. There's no need to get more complicated than is necessary for your situation."

That said, "if your business gets off the ground and you can afford to start saving more, then you can consider opening up a SEP IRA on top of your traditional or Roth IRA and save even more."

Fund a normal investment account

"There's no rule that says you have to save for retirement in your retirement account," says Holeman.

The IRAs mentioned above "have some nice tax benefits, so that should be where you start," he notes, "but they have some restrictions on them," such as contribution limits and when you can withdraw the money. If you dip into an IRA before age 59 ½ you'll get hit with an early withdrawal fee.

"For someone who wants a little more flexibility or is thinking about retiring early, it might make sense to save money outside of these retirement accounts, in a normal investment account," says Holeman. "You don't get as many tax benefits, but you have a lot more flexibility: There's no age restrictions on pulling the money out and there's no contribution limit."

Start by reading up on the best online brokerages. You can also store money in a high-yield savings account or consider robo-advisors. Just be sure to mark these accounts for retirement if that's what you intend to use them for.

Fund a health savings account (HSA)

Health savings accounts also are not designed specifically for retirement, but they can be a powerful retirement-savings tool.

With an HSA, you can put pre-tax money towards medical costs to be used whenever you want. There's no "use-it-or-lose-it" rule: Any unused funds will roll over to the next year.

The main requirement for opening an HSA is having a high-deductible health care plan (HDHP), one that offers a lower health insurance premium and a high deductible. This is a good option for those who are generally healthy and don't have to go to the doctor's office or hospital that often, Holeman says: "If you are on medications, have a chronic illness or might be going to the doctor often, then having a high-deductible will probably be very expensive for you."

The HSA contribution limit is $3,450 per year if you're single, and $6,900 per year if you have a family, plus an additional $1,000 if you're over 55 years old.

"It's less money that you can put in compared to other accounts," says Holeman, "so this alone is not going to be nearly enough for you to save for your retirement, but it can be a nice addition to your normal savings."

How do you decide which account to open?

Before you even decide what type of account to fund, establish how much you need to save each year to set yourself up for a comfortable retirement, says Holeman. Then you can think about what account makes the most sense for you to open.

"If you know the money is for retirement, then you should start with your IRAs," says Holeman. Besides offering major tax benefits, stashing money in an IRA will create a barrier between your retirement savings and your other savings, so you don't end up blowing it on a vacation or impulse purchase: "People tend to know that their IRA is strictly for retirement. And there's the added rule that you get penalized if you withdraw money early."

Plus, when you put your savings in different "buckets," you can invest them more strategically, says Holeman: "For example, if you're younger, you won't be touching your retirement accounts for 20, 30 or 40 years, so you can afford to take more risk with those accounts, whereas if you're going to buy a house in two years, you want to take a lot less risk because if the market goes down, you might not be able to make the down payment on the house that you just closed on."

If you're planning on retiring early, you may want to consider putting money in a normal investment account that you can access whenever.

Most importantly, start building your nest egg today. And if you don't have the option of investing in a 401(k) plan, don't think of that as a disadvantage. "Having an employer-sponsored retirement plan with a match is nice," Holeman says, but at the same time, you're restricted in a way because "you're stuck with the 401(k) provider that your employer chose."

On the flip side, if you don't have access to a 401(k) plan and have to take matters into your own hands, you have a lot more flexibility: "You can open up an IRA at whatever company you want: Betterment, Vanguard, Charles Schwab, Fidelity, JPMorgan. You can make sure that you pick a company that has the types of investments you're looking for, great tax benefits, a good fee structure, a good user interface and all of those things that are really important."

Check out how much you should have stashed away at every age and start saving today.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Everything you need to know about 401(k)'s, IRAs and other retirement savings accounts