Americans are earning more than ever before. The median household income rose 3.2 percent between 2015 and 2016, to a new record of $59,039. That beats the previous record high of $58,665, set in 1999, according to data released from the U.S. Census Bureau on Tuesday.

The official poverty rate has also decreased by 0.8 percent.

The new high also represents "the first time since the recession ended in 2009 that the typical household earned more than it did in 2007, when the recession began," the Associated Press reports.

There are two good reasons to applaud the milestone. It means there's a little more money in Americans' pockets. And it means that the economy is finally recovering from the financial crisis.

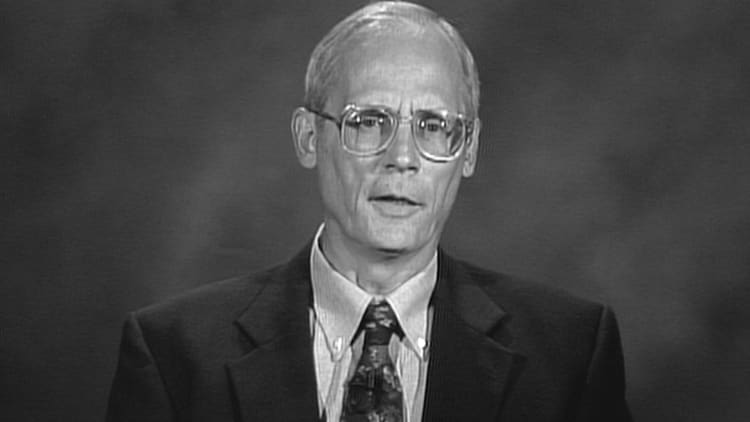

"This is the final piece of the puzzle falling into place for economic recovery," Greg McBride, chief financial analyst at Bankrate, tells CNBC Make It. "The growth in wages and household income has really only materialized in the past couple of years."

The increase can largely be attributed to lowered unemployment rates, an increase in job creation as the economy grows and a tightening of the labor market, McBride says. In fields such as computer science, engineering and healthcare, a shortage of qualified workers puts pressure on wages.

"It's supply and demand," McBride says. "Employers that have open positions are finding that they have to pay a little bit more to attract qualified candidates. Oftentimes, you're going to have to outbid your rival in order to bring that qualified candidate on board."

What really matters for Americans is that incomes aren't only going up, they're also outpacing inflation. "That's where households get the wherewithal to improve their lifestyle and have increased buying power," McBride says.

Look at it this way: If you get a 3 percent raise, but your expenses increase by 3 percent as well, your situation hasn't improved. But if your income increases 6 percent and your expenses go up by only 3 percent, you come out on top.

That's what's finally happening in the U.S., and it's giving families a much-needed chance to improve their lifestyles and increase their savings. According to a 2017 GOBankingRates survey, 57 percent of Americans have less than $1,000 in their savings accounts, which, though alarming, is an improvement from last year: In 2016, 69 percent of Americans were in that position.

More income will allow families to contribute to retirement accounts and saving up to buy a home. And the ability to pay off loans is also significant, considering that the average American family owes $8,377 in credit card debt.

McBride says that it's important for Americans to realize that not everyone will personally see these shifts in their own salary right away. Still, he believes that the rise in median household income is positive for the country and economy overall.

Like this story? Like CNBC Make It on Facebook

Don't miss: