After seven years of working at an investment firm in New York City, a woman who goes by the pen name J.P. Livingston on her blog The Money Habit had built a $2.25 million nest egg, enough to quit her job and retire at age 28.

She did it thanks to a series of raises that put her income in the mid-six figures and then developing a savings rate of more than 70 percent. Wisely invested, her money turned into a small fortune.

"I really do believe that early retirement, or financial independence at an early age, is an option for so many more people than believe it is an option for," she tells CNBC Make It.

On her blog, she shares her "quick start guide to early retirement," which she believes many people can follow to achieve what she did.

1. Up your savings rate

Saving is a huge component of early retirement. As Livingston puts it: "Even if you have the best investment strategy in the world that yields 5 percent more a year than other strategies, you won't see a huge impact if you only have $10 in savings to put to work in it."

To save big, start with your two biggest line items — housing and food — and cut back, says Livingston: "Focusing on big ticket items can get you to perhaps a 20 to 30 percent savings rate, but the rest of your progress will likely be made up by small enhancements," like canceling underused memberships, cutting back on impulse purchases and avoiding late fees.

Other early retirees have also had success taking the opposite approach: They suggest you start with small changes, which will lead you to be able to make bigger ones. Choose whichever strategy will work best for you.

2. Increase your income

If you earn more, you can save and invest more, which will help you achieve financial independence sooner.

Boosting your income could mean asking for a raise or getting promoted, which is what Livingston did, or starting a side hustle or picking up hours at a different gig.

"It is a good time to focus on this [step] when you have at least three years of work under your belt," says Livingston. "With three years of work behind you, you have real work experience you can parlay into a higher paying job and/or you are probably stable enough in your life to make for side hustles."

Read up on negotiation strategies that will help you get paid what you're worth and simple steps for launching a successful side hustle in a month.

3. Put your money to work

Once you've upped your savings rate and maximized your income, you can turn your attention to growing your money.

After all, as some early retirees say, saving money alone doesn't get you rich but investing can. As Livingston explains: "At some point, your money pile grows to a size where focusing on growing your nest egg will have a much more material impact to your net wealth than further reductions on your spending."

The simplest starting point is to invest in your employer's 401(k) plan, a tax-advantaged retirement savings account or other retirement savings account, such as a Roth IRA or traditional IRA. You can also research low-cost index funds, which Warren Buffett recommends, and online investment platforms known as robo-advisors.

4. Optimize your taxes

"As your nest egg gets bigger, your focus usually switches to tax efficiency," Livingston writes. Just by understanding the tax code, "you can cut your retirement timeline by years."

You'll want to start thinking about "what sort of investments go in your taxable accounts vs. tax advantaged accounts, like 401(k)s and IRAs," says Livingston. "Ideally, the investments that must actually realize gains and income (for example, selling options, getting dividends that aren't tax exempt) should go in the tax advantaged accounts."

Read up on how to protect retirement income from taxes and how to invest for a mostly tax-free retirement.

Like this story? Like CNBC Make It on Facebook!

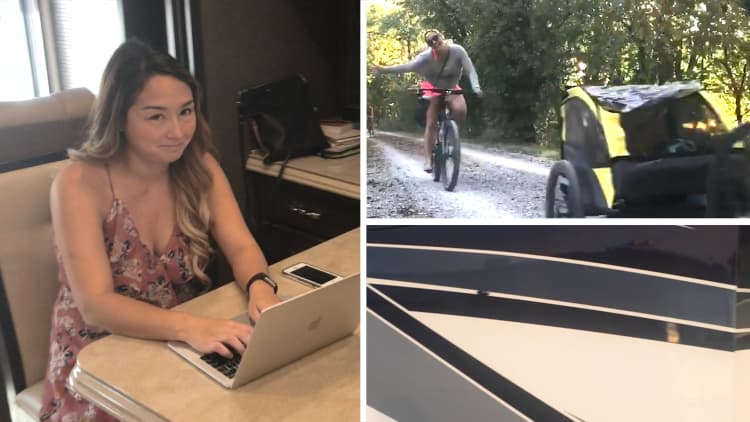

Don't miss: This couple retired in their 30s and are now traveling full time in an Airstream

Video by Jonathan Fazio