A lot of ordinary people have managed to save extraordinary amounts of money. Take early retirees Justin and Kaisorn McCurry, who banked more than $1 million in a decade.

They've shown us that you don't necessarily need a Wall Street salary to reach financial independence at a young age. At the McCurry's peak earning period, they were making a combined $138,000.

You do, however, need the discipline to keep a large chunk of your paycheck, which is exactly what the McCurry's and other super-savers do.

Here are some of the best lessons we've learned from people who save at least 50 percent of their income.

1. Automate everything

In just five years, Grant Sabatier of "Millennial Money" went from having $2.26 in his bank account to $1 million. During his five-year journey to seven figures, in addition to focusing on earning, he saved 50 percent of his income.

The key to saving half your income, he says, is to make things automatic: "Automation is essential. When I first started saving and investing, I was a little more old school — I was trying to invest as much as possible into the online savings accounts I had set up and it was a pretty manual process. Now, one of the biggest recommendations I make is to automate as much of your savings as possible."

The reason it works is because you'll never be tempted to skimp on savings since you'll never see your money going automatically from your paycheck to your savings accounts.

2. Think about purchases in terms of cost per hour

"To achieve a high savings rate, start viewing your purchases in terms of units of your time rather than dollars," says J.P. Livingston of "The Money Habit," who stashed more than 70 percent of her income and built a nest egg of $2.25 million before age 30. "So instead of saying a new unlocked iPhone costs $800, you might do the math to figure out it would cost you 60 hours of work, or a week and a half of your life."

It really makes you question whether any given item is worth the money.

"This is great for big purchases," the New York City-based early retiree tells CNBC Make It. "To buy a home with an extra bedroom or one with fancier finishings might cost you $50,000 or $100,000. Is that worth working three extra years to you?"

3. Go homemade

"This one was the biggest 'aha' moment of the year for me," writes Matt, who asked to remain anonymous, of "Distilled Dollar," a Chicago-based CPA who saves 60 percent of his income with his fiancee and plans to be financially independent by age 35.

Matt estimates that they save about $5,000 a year by going out less. "Not only did we start to cook more, but we found creative ways to save money at the grocery store," he says. "Plus, we are eating much healthier now, too."

Check out more tips on how to trim your grocery bill.

4. Focus on cutting the "big three expenses"

Keep the "big three expenses" — housing, transportation and food — as low as possible, says early retiree Justin McCurry. "Look at those top expenses and see if there's any negotiating room." Doing so helped him and his wife save up to 70 percent of their income and build a $1 million portfolio in a decade.

They stayed in the starter home they bought out of grad school and paid off their mortgage in 2015, meaning that, on a monthly basis, they only cover utilities and maintenance. In terms of transportation, "we kept the cars that we bought brand-new in college for 16 years and just replaced them last year," says McCurry.

And they only budget $500 a month for groceries. You can read more about how they feed a family of five for $500 a month on their blog, "Root of Good."

5. Bank your raises

Start thinking of money as something to invest rather than something to spend, says McCurry. Anytime he or his wife earned a raise, the extra money went straight to their accounts.

You can apply the same strategy to a bonus, birthday check or small windfall. Instead of planning trips or grabbing gadgets, consider directing at least some of it towards lingering debt, a retirement savings account or an emergency fund.

To resist the temptation to spend any surplus money that comes your way, send it directly to savings. That way you'll hardly even register that it's there.

6. Distinguish 'wants' from 'needs' by tracking expenses

Steve and Courtney Adcock decided to double down on their savings in order to retire early. They slashed their spending to the point where they were banking 70 percent of their income, and it all started with tracking their purchases in an Excel spreadsheet.

"We know exactly what we bring in and exactly what we spend … and on what," writes Adcock. "Knowing where our money goes is critical to maximizing our savings and pinpointing where we could probably cut back."

They cut back a lot. "For the most part, we went cold turkey," Adcock tells CNBC Make It. "We cut out everything that we didn't think was necessary."

If you don't want to use an Excel spreadsheet, try recording expense in a notebook or using an app like Mint, Personal Capital or Level Money.

This is an update of a previously published story.

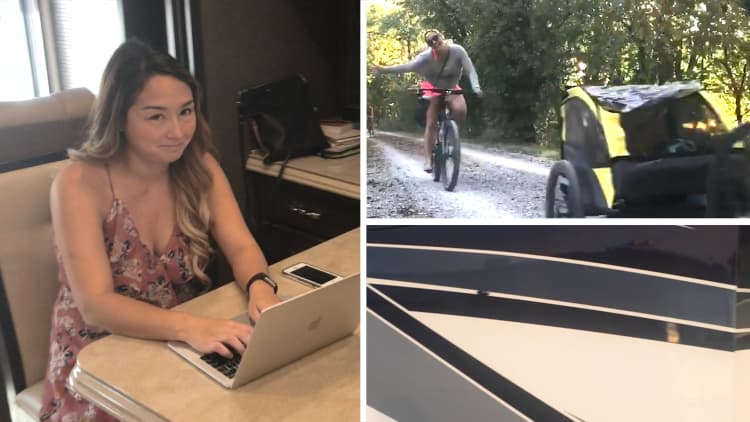

Don't miss: This couple retired in their 30s and are now traveling full time in an Airstream

Video by Jonathan Fazio