U.S. stock index futures were higher Tuesday, amid hopes of progress toward resolution of the "fiscal cliff" in Washington.

Hopes for a deal grew on Monday after President Barack Obama made a counter-offer to Republicans that included a major change in position on tax hikes for the wealthy. Obama is looking for $1.2 trillion in higher tax revenue from those earning more than $400,000, and would implement $1.22 trillion in spending cuts, including to some social programs, according to reports.

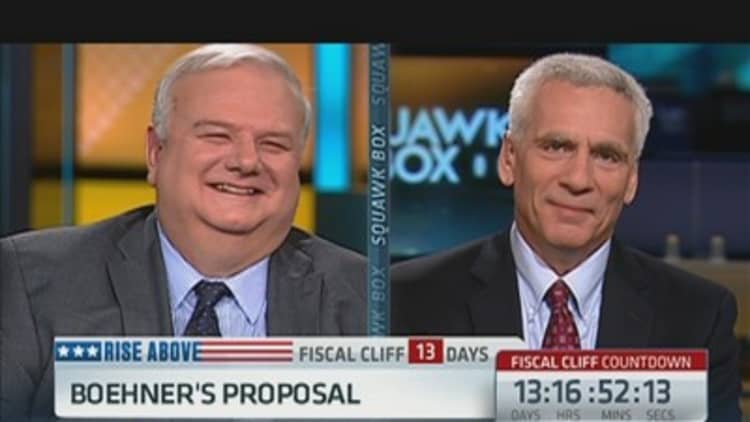

The new offer was welcomed, albeit with reservations, by a spokesman for Republican House of Representatives Speaker John Boehner. (Read More: US 'Fiscal Cliff' Deal Closer, but a Divide Remains)

On the economic front, the U.S. current account deficit fell more than expected in the third quarter to $107.5 billion, the lowest in nearly two years, according to the Commerce Department. Economists polled by Reuters expected a reading of $103.4 billion.

The National Association of Home Builders' market sentiment index for December will be released at 10 am ET. The index stood at 46 in the prior month.

Financials gained after widely-followed bank analyst Meredith Whitney turned bullish the sector. Whitney also upgraded Bank of America, Citigroup and Discover Financial to "buy" from "hold."

Apple rose after the iPhone maker was reiterated with an "outperform" rating at Cowen. Separately, rival Samsung says it will withdraw European injunction requests against Apple, according to a report from Bloomberg.

Arbitron surged after Nielsen said it will acquire the radio station ratings provider in a .

Oracle is scheduled to post earnings after the closing bell.

—By CNBC's JeeYeon Park (Follow JeeYeon on Twitter: @JeeYeonParkCNBC)

Coming Up This Week:

TUESDAY: Housing market index, 5-yr note auction, Fed's Fisher speaks; Earnings from Oracle

WEDNESDAY: MBA mortgage apps, housing starts, oil inventories, 7-yr note auction; Earnings from FedEx, General Mills, Accenture, Bed Bath & Beyond

THURSDAY: GDP, jobless claims, corporate profits, existing home sales, Philadelphia Fed survey, FHFA home price index, leading indicators, Fed balance sheet/money supply, UPS busiest day; Earnings froM CarMax, ConAgra, Darden Restaurants, Discover Financial, Rite Aid, Nike, RIMM, Micron

FRIDAY: Quadruple witching, personal income & outlays, Chicago Fed activity index, consumer sentiment, BLS state employment stats; Earnings from Walgreen

More From CNBC.com: