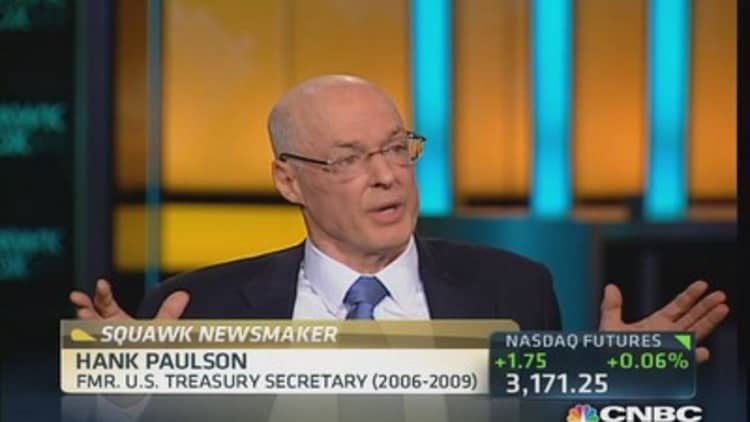

The 2008 financial crisis was a 100-year storm, and no one involved in it had ever seen anything like it, former Treasury Secretary Hank Paulson told CNBC on Friday—nearly five years since the bankruptcy of Lehman Brothers.

"This was a massive credit bubble that burst and I just think this was a major dislocation," he said in a "Squawk Box" interview. "We're fortunate to be where we are right now."

Paulson, a former chairman and CEO of Goldman Sachs, headed-up Treasury during the crisis and helped engineer the then-$700 billion Troubled Asset Relief Program (TARP)—the bailout credited with preventing the collapse of the financial system.

(Read more: Dislike of Wall Street hasn't faded with crisis)

"I interacted with a lot of CEOs running major firms during the crisis. Some of the CEOs were more able than others. I think they were all good men, and they were dealing with a crisis the likes of which they'd never seen in their lifetimes," he said. "This was a 100-year storm. These excesses had been building for years and years. Most of them performed very, very well under stress and most of them did everything they could to cooperate."

At the time, he also worked closely with Federal Reserve Chairman Ben Bernanke, and said in Friday's interview that choosing Bernanke as Fed chief was one of the best decisions President George W. Bush had made.

As for who should take over for Bernanke, Paulson said both Janet Yellen, central bank vice chair, and former Treasury secretary and Obama economic adviser Larry Summers are both capable.

He said he knows Summers a lot better than Yellen. "I like Larry. He's a very able guy. I'm a friend of Larry," Paulson said. But he said that he's not entering into the debate because he's been "distressed at the extent to which it has been politicized." Paulson added, "I don't know how this happened, but it shouldn't be. It's too important a job."

(Read more: Summers for Fed chief report moves dollar)

On the U.S. economy, he said it's incredible how much growth there's been while deleveraging.

"The capital program we designed to get out [of the crisis] and put capital into hundreds of banks very, very quickly and recapitalized the U.S. financial system, is a huge success," Paulson reflected. "That money has come back, all that, plus $32 billion."

"I am a believer in the Ben Bernanke stimulus programs [that followed]," he continued, "in the sense that I think it's remarkable, even though we have low growth, this economy has been growing at 2 percent since 2009."

But Paulson acknowledged that investors need to look to the day when extremely low interest rates end. "You can only do so much with low interest rates."

The Fed has said that rates will remain near zero for the foreseeable future. Next week, central bank policymakers are scheduled to meet, and investors will be looking for rate guidance, but the bigger question will be whether the Fed will announce a decision to start scaling back its $85-billion-a-month bond-buying program.

Paulson didn't comment on Fed tapering, but described the eventuality of a "new world when assets trade ... by their returns [and] economies are judged on their fundamentals."

He also said that the U.S. economy could get a boost if Washington undertook major structural reforms, including taxes and immigration.

—By CNBC's Matthew J. Belvedere; Follow him on Twitter @Matt_SquawkCNBC.