There's not enough supply in Hong Kong; that's what KL Wong, CEO of the Hong Kong Housing Society readily admits when discussing the problem of elderly housing in the Special Administrative Region.

Wong concedes that there are still many barriers to providing adequate supply, despite the number of profit and non-profit property providers in Hong Kong.

"It is quite a serious problem," he quips. "We need to talk to the government about land for elderly people, because there are many other priorities for housing in Hong Kong. We need to convince the government that elderly housing is in big demand."

(Read more: The aging in Asia face a new decade like no other)

A non-profit organization, the Hong Kong Housing Society currently offers rental flats for the lower income group at about half the market rate. But it only has about 900 such flats in its portfolio.

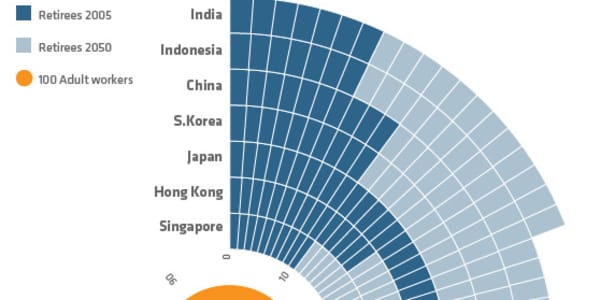

Long considered one of the most expensive cities in the world, about 13 percent of Hong Kong's population is 65 and above. By 2030, the figure is expected to balloon to 1 in 4 people, making the issue of housing the elderly particularly pressing.

The Elderly Commission a government advisory group estimates that over 50 percent of the elderly are now living in subsidized housing.

But it warns the housing woes affect not just the elderly poor, but also those in the middle income group.

"Those with median income, they could not afford private housing, and yet public housing is only for the poor sector of the population. So they are fairly desperate," says Professor Alfred Chan, Chairman of the Elderly Commission.

(Read more: Hong Kong's property developers locked in a price war)

But Chan knows that coming up with a viable alternative won't be easy.

"Housing is monopolized by the developers in Hong Kong, therefore it is very difficult for the government to maintain prices at an affordable level. The other way is to increase the supply of land. But this is tough, partly due to the pressures from the developers, but also because Hong Kong is a very small place."

To help solve the housing problem for the middle income group, the Hong Kong Housing Society offers life-leases for elderly tenants that fulfilled the criteria via means testing. With the upfront payment, life –leases give tenants a life-time right to occupy the flats.

(Watch now: IsCorrection Due for Hong Kong Property?)

It currently has two such projects in its portfolio. These are partially subsidized, as the government imposed no premium on the land the projects sit on.

Residents are charged an entry contribution for a life-lease, in return for resources to live independently in the self-contained facilities.

For instance, 72-year old Sidney Lam has been staying in an elderly housing project called Cheerful Court at Jordan Valley, near Hong Kong's Kowloon Bay for nearly two years.

(Read more: China, HK real estate markets to thrive: Pro)

Lam had to pay an initial entry fee of HK$600,000, (US$77,374) plus maintenance of HK$2,000 (US$ 258) each month, to stay in a one-bedroom flat with his wife. The fee includes services like a monthly medical checkup, which Lam deems reasonable.

Despite the lower costs, the scheme wasn't well-received initially. "Traditionally, the Chinese prefer to own their own flat, rather than opting for a life-lease, which has no investment value. But as time goes by, it seems to become quite popular, as people like living with those of the same age and social standing," says Wong.

Today, there are more than 300 people on the waiting list. Most will likely wait three years or more for an available spot.

(Watch now: HongKong property demand strong despite curbs)

The Hong Kong Housing Society is also experimenting with a new type of elderly housing project, due to be completed sometime next year. These are not subsidized, and will not require tenants to go through means testing. They are aimed primarily at those who already owned their flats, but are looking to liquidate their fixed assets.

The pricing has not been announced just yet. "We would probably charge the tenants an entry contribution, which would be some 50 percent to 60 percent of the market price, in return for a life-lease. I am not sure if this would be successful, but I believe there is a market for it," says Wong. "We're quite prepared to invest more in this area, to help our tenants live safely and happily in our estates."

— Follow CNBC on Twitter: @CNBCWorld