(Click for video linked to a searchable transcript of this Mad Money segment)

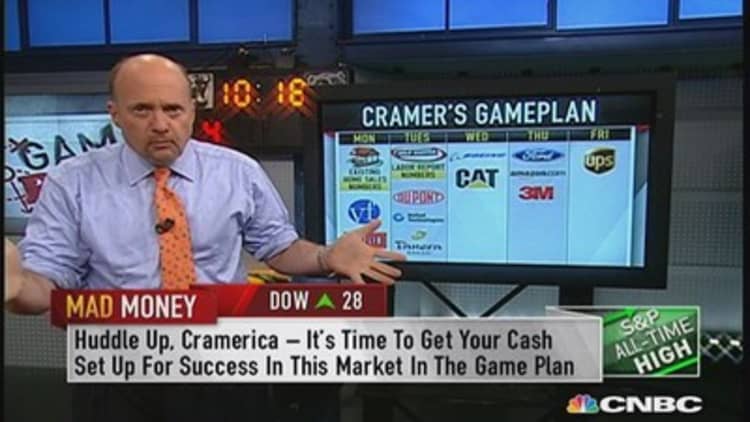

With the debt debacle back on the rear burner, Cramer expects earnings to take center stage in the week ahead.

And what a week it will be.

"Next week is the big week," Cramer said. "More earnings will come out over the next 5-day span than at any other time during the quarter. Thank heavens this only happens four times a year. By Friday we'll all be exhausted!"

Amid a sea of revenue forecasts, upside surprises, full year guidance and more, here are the 10 reports that Cramer wouldn't miss.

MONDAY OCTOBER 21ST

On Monday Cramer will be watching VF Corp as read on shopping trends. "Lately, people have been spending more on hard goods rather than apparel. VF Corp could provide some valuable insights into whether the trend continues or not."

Also on Monday growth will be a major theme as Netflix reports. "If this company hits the high-end of its forecasts, reporting that it signed up 1.5 million new subscribers in this country and 1.25 million overseas, then I think it could easily have a 10% move higher," Cramer said.

TUESDAY OCTOBER 22ND

Tuesday is Friday this month. That is, the Labor Department will release the jobs report which was delayed because of the government shutdown.

"I think the jobs report could give you the opportunity needed to buy some high quality earnings stories at lower levels than where they are now because a strong jobs number should increase talk of a taper. In turn stocks should trade lower."

Also, on Tuesday chemical company DuPont takes center stage. "Many want to hear about a two company solution: a splitting into a cyclical commodity business and a secular growing engineering concern. We get that, the stock pops 10%. We just get in-line earnings then I believe the stock goes down. Wide variability here. "

Also Cramer will have bread on the brain as Panera reports. "I'd keep my powder dry but also stay nimble. Let's see what they have to say."

WEDNESDAY OCTOBER 23RD

On Wednesday aerospace will land on the radar as Boeing releases its results. "I've been telling you this stock's a buy on any weakness since it was trading in the $60s. Today it closed over $122. But I'm still a buyer of pullbacks."

Also Cramer is eager to hear from one of the most beleaguered stocks in the entire S&P 500 - Caterpillar. "I have to tell you that this one might be worth some out of the money call options. Recently we had a very confident United Rentals on the show. They are a huge Caterpillar customers, and all I heard was how demand is spiking for construction equipment. When I meld that with the sharply better than expected Chinese GDP number and the radical turn in the fortunes of Europe, I have to think Caterpillar could raise guidance for 2014. If that happens I expect this stock to shoot past $90."

THURSDAY OCTOBER 24TH

The health of the auto industry comes into focus with earnings from Ford. "My charitable trust is just itching to buy more of it on any weakness. We can see it going to $20, easily, next year on a European renaissance."

In addition Cramer will be watching numbers from Amazon. "Repeat after me: I will not trade Amazon until I hear the conference call. This stock has been a notoriously crazy beast on earnings day as people try to use headline numbers to predict its moves. Folks, it doesn't work. Wait for the call."

Also, Post-Its and Scotch tape will command Cramer's attention as 3M reports. "Do you know that 3M trades down almost every time it reports? That's been an amazing opportunity."

---------------------------------------------------------------

Read More from Mad Money with Jim Cramer

3 earnings that really impressed Cramer

2 stocks the Street doesn't get

Beltway bickering doing permanent damage?

---------------------------------------------------------------

FRIDAY OCTOBER 25TH

Shipping will steal the spotlight on Friday as UPS reports. "I think that United Parcel is worth listening to and perhaps even buying as it, too, has a habit of selling off on the news."

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com