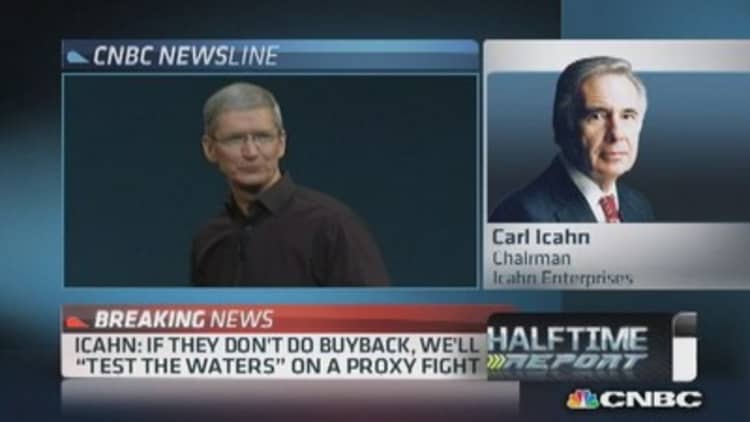

Apple is undervalued and a massive buyback of shares is a "no brainer," billionaire investor Carl Icahn said on Thursday, adding that he could consider a proxy fight if the company did not buy back more shares.

"If they don't do it, we'll test the waters and see if the shareholders want us to do it and if we could win," Icahn told CNBC. "We've said we're not going away. I've said that to (CEO) Tim (Cook) and I'll say it again."

(Watch: The full Icahn interview)

Icahn also said his basis in the stock was about $440 a share and that a buyback would be compelling even at $550 or $570 a share.

"At these values we think it's still very cheap," he said. "I do presently intend to buy it."

Apple shares rose 1.2 percent to $531 in midday trading. At those prices, Icahn's stake in the company represents a profit of about $428 million, based on a holding of around 4.7 million shares. (What's the stock doing now? Click here)

(Read more: Icahn-Netflix trade teaches a lesson)

Earlier Thursday, Icahn asked Apple to commence an immediate tender offer—to the tune of $150 billion—in a letter to Cook.

The letter, issued in conjunction with the launch of Icahn's new website "Shareholders Square Table," comes after Icahn previously urged Cook to use Apple's $150 billion in surplus cash to buy back company shares.

"I have no criticism of Tim Cook. I think he's doing a great job, but I think it's an obvious thing to do," Icahn said in the interview, rejecting the notion that Apple would have to spend all of its cash to buy back the stock.

"They have plenty of money to do innovation. They can borrow whatever they want. The $150 billion is sitting there doing nothing," he said.

(Read more: Text of Icahn's letter to Apple)

Icahn said he expects to talk with Cook again sometime after Apple reports earnings Oct. 28.