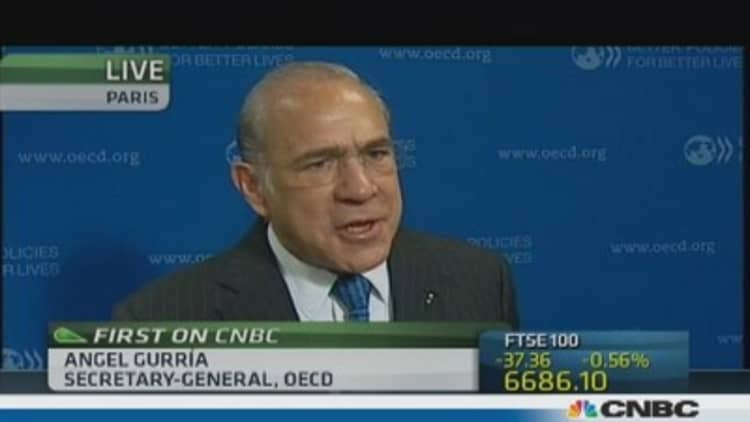

A U.S. debt default would create significant confusion and uncertainty in financial markets and could prove as catastrophic as the failure of Lehman Brothers in 2008, the Organization for Economic Cooperation and Development (OECD) said in a new report.

Lawmakers in the U.S. side-stepped a debt default at the 11th eleventh hour in October and brought an end to prolonged negotiations over raising the debt ceiling. But talks are set to resume in the new year with the debt ceiling extended until February 7 and funding approved until January 15.

"An outright default would have extremely severe effects" the OECD said in the report, released on Tuesday.

"It would be likely to create large confusion and uncertainty in financial markets given the importance of U.S. government bond rates in pricing financial instruments worldwide and the widespread use of U.S. government bonds as collateral in many financial operations, and trigger a systemic flight to liquidity that could prove as catastrophic and costly as that in the day following the Lehman failure in 2008."

Even the possibility of an outright default would unsettle financial markets worldwide, and damage confidence, the OECD said, calling for the scrapping of the nominal debt ceiling altogether, so that the borrowing implied by budgets and resolutions passed by Congress is authorized automatically.

(Read More: US fiscal 'fiasco' biggest threat for 2014: Nomura)

In another scenario, it predicted that if the lawmakers couldn't reach an agreement on the debt ceiling and an extension was not an option, it would have "large adverse effects on the stability and growth of the world economy."

"A failure to raise the debt ceiling would likely be accompanied by a severe deterioration in financial conditions, with significant declines in equity prices worldwide, a higher term premium on U.S. government debt and, possibly, a worldwide rise in risk aversion." it said.

It estimates that even in the absence of adverse financial effects, a contraction of at least 4 percent of GDP (gross domestic product) in federal spending would be required to achieve a balanced budget. The U.S. economy would be pushed into recession immediately, with large negative spillover effects on other economies and substantive disinflationary pressures, it added.

"If, as most likely, the expenditure reduction was accompanied by deteriorating financial conditions, the consequences for the global economy would be much more severe, with a contraction of at least 5 percent of GDP in federal spending required for a balanced budget. The OECD as a whole would be in recession, with more than an additional 5 million people becoming unemployed," it said.

Emerging markets weigh

As the well as the stark warnings on a possible debt default, the OECD said the world economy is set to grow at a sharply lower rate than originally forecast due to concerns about the effect that U.S. monetary policy is having on emerging countries.

Growth outcomes for this year and next have been slashed by a half of a percentage point since its last update in May. The OECD now sees global GDP (gross domestic product) revised down to 2.7 percent this year and 3.6 percent for next year.

"Almost all of this reflects a further growth slowdown in the large emerging market economies (EMEs), which is tempering the pace of the recovery in the OECD economies," the report stated. "The global recovery remains modest and uneven."

The main drag to these emerging economies is the expected moderation of central bank bond-buying programs in the U.S., it said. The U.S. Federal Reserve is currently pumping $85 billion a month into the U.S. Treasury market. Having a huge buyer in this bond market has meant prices have soared, whilst any potential yield has been suppressed.

A consequence of this has been that investors have looked elsewhere for yield, with emerging markets being one place that has benefited. This came to a sudden end in May when the Fed signaled that it was looking to start to begin to take this liquidity out of circulation. Investors looked to bring their money home. As a result emerging market currencies plunged against the dollar.

Local currency-denominated EM debt also saw a sell-off, after a positive start to the year. Pimco's "EM advantage local bond index" exchange-traded fund wiped out its year-to-date gains with similar moves seen in emerging market funds from JPMorgan and BoA Merrill Lynch.

(Read More: Expect a lackluster 2014 for global equities: HSBC)

In certain cases these sudden falls have been reversed in recent months, but OECD still sees an underlying threat.

"The anticipation and actual start of the monetary stimulus withdrawal in the United States could have adverse global spillover effects, especially if it results in financial market instability. Emerging market economies are particularly vulnerable to shifts in investor sentiment and some will possibly come under pressure to raise interest rates at a time when the economy is weak. Possible turmoil in EMEs and its feedback to advanced economies would magnify the challenges of managing the exit," it said.

Monetary policy crucial

The economic forum, which includes 34 nations, also said that the current high levels of unemployment across the OECD will only decline by a half of a percentage point over the next two years to 7.5 percent by end-2015. Inflation was also projected to remain weak in many OECD economies and moderate only gradually in most EMEs.

(Read More: Middle East tension the top concern for 2014: WEF)

OECD warned that central banks across the globe have to make sure their economic policies are in step with the global environment and any monetary easing is perfectly timed and done with caution. The current accommodative policy rates in the U.S. and the U.K. are likely to remain appropriate for some time, it said, adding that the Fed should look to increase interest rates in early 2015 with the Bank of England following suit later in the year later.

In contrast, the OECD said the monetary stance in the euro area for the next two years should remain unchanged, provided disinflationary pressures do not intensify further. Strong quantitative and qualitative monetary easing should also be implemented as planned in Japan, it added.

By CNBC.com's Matt Clinch. Follow him on Twitter @mattclinch81