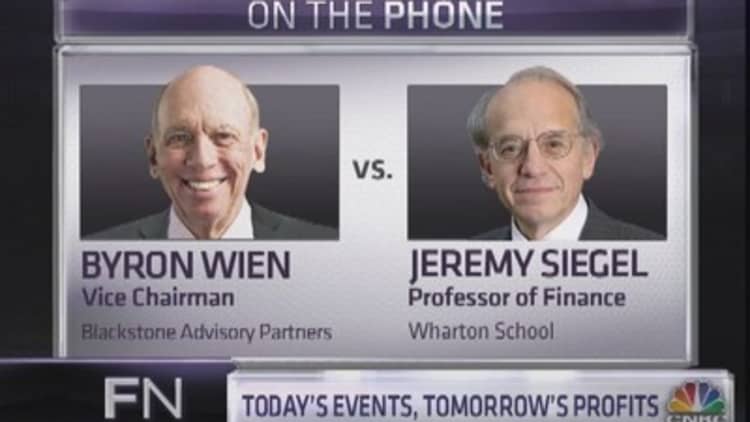

Byron Wien and Jeremy Siegel both say stocks are headed higher. But while Wien says that the Federal Reserve's quantitative easing policies have been a big part of the market's bull run, Siegel believes that the effect of the Fed has been badly overstated.

"I think a large part of the appreciation in the market this year is a result of Federal Reserve monetary accommodation," said Wien, the vice chair of Blackstone Advisory Partners. "That's what drove the market. It drove stock prices higher, and it kept interest rates low."

(Read more: Byron Wien: Why I've become bullish on the market)

But Siegel, professor of finance at the Wharton School and one of the best-known market bulls, takes issue with that characterization.

"I have to disagree with you here," Siegel directly told Wien on Thursday's episode of "Futures Now." "I think that one of the biggest myths on Wall Street is that it's QE that's driving the market."

"I'm looking at the earnings and the interest rate and saying, 'I can certainly justify these prices without having to resort to QE,' " Siegel continued.

(Read more: You're wrong—QE has not boosted stocks: McKinsey)

Because he doesn't think the Fed's $85 billion-per-month bond-buying program has been the main driver behind stocks, he doesn't think that a reduction, or tapering, of that program will have a traumatic impact on the market.

Market participants "are so fixated, like the only reason the stock market's going up is QE, so any hint that QE's going to stop sends shivers town the market. That's crazy," Siegel said. "So I'm hoping that the market wises up and says, you know what? Maybe there's good reason to buy this even though there's going to be a taper."

"I agree that tapering will cause some shivers in the stock investor's mind," Wien acknowledged, but "the Fed is only going to taper aggressively if the economy is really improving. And then we're going to realize these optimistic earnings figures. Then you don't want to be in bonds, and you do want to be in stocks."

(Read more: BlackRock bond guru: Now I prefer stocks to bonds)

Wien, for his part, agrees with Siegel on earnings and valuation.

"Well I think quantitative easing had a lot to do with the run in the market, but I agree with you on valuation," Wien responded.

That's why, despite the importance he places on QE, Wien is not sweating a Fed taper either.

"If the Fed tapers because the economy is strong, you're going to see that reflected in better earnings." Wein said. "But the key thing, I think, is valuation. We're going to have up earnings next year, maybe it'll be $112 or $115 (in S&P 500 full-year earnings)—but the current multiple could expand somewhat even if interest rates rise, and that should produce a higher stock market."

—By CNBC's Alex Rosenberg. Follow him on Twitter: @CNBCAlex.

Watch "Futures Now" Tuesdays and Thursdays at 1 p.m. ET exclusively on FuturesNow.CNBC.com!

Like us on Facebook! Facebook.com/CNBCFuturesNow.

Follow us on Twitter! @CNBCFuturesNow.