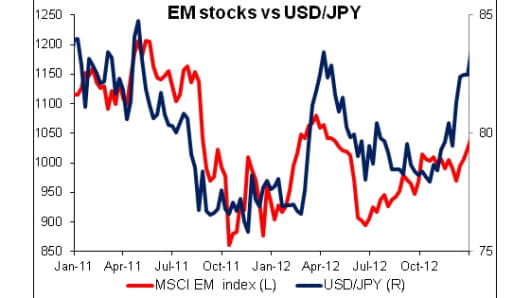

While many pundits – including me – expect the yen to weaken this year, the market never moves in a straight line. The crisis in emerging markets is negative for the yen over the longer term, yet in the short term it's a big positive that will likely see the yen gain strength as the turmoil continues.

The emerging market crisis is bad for Japan in the long term as these are important markets for Japanese goods. Over half of Japan's exports go to emerging markets, with 18 percent going to China alone and 29 percent going to Greater China, including Taiwan and Hong Kong. Thus, a slowdown in these markets or a reduction in their purchasing power would offset to some degree the boost to exports that Japan gets from a weaker yen.

(Read more: Stand by: EM turmoil sparks credit crunch fears)

However, it may help to increase inflation insofar as the price of imports rises, but that's "bad inflation", not "good inflation" stemming from a rise in demand that allows companies to raise their profits and prices.