At some point over the next few years, the rate of money flow and inflation will start to catch up to each other, eventually sending the economy into a recession, according to a new analysis from banking analyst Dick Bove.

The good news in Bove's forecast is that the day of reckoning is probably four years away.

The bad news is that a 7 percent rate in the 10-year note looms out there, something that would put a severe crimp in the current debt-happy economy.

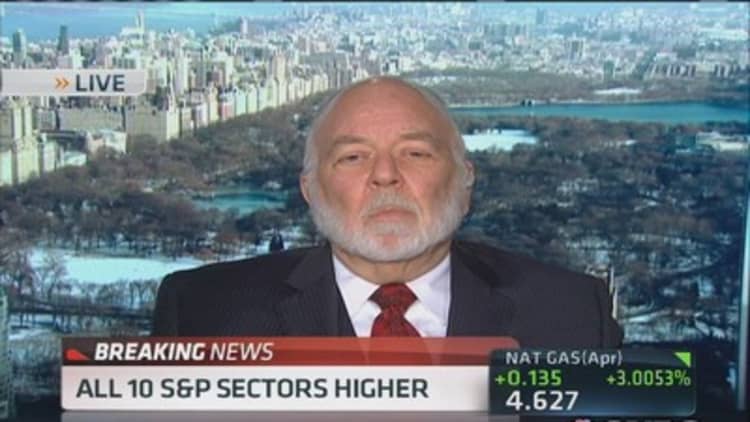

"In order to develop earnings models for banking companies, as everyone knows, you must have a 'worldview' related to money supply, the economy, inflation and interest rates," Bove, vice president of equity research at Rafferty Capital Markets, said in a note to clients Monday. "The view that I am using ... implies a relatively fast growing economy, increasing rates of inflation, much higher interest rates, and a move back to recession by 2018."

(Read more: This is what could end stock bull market: Paulsen)

The key variable Bove uses in his analysis is money flow, expressed by the Federal Reserve using symbols M1 and M2. The former is primarily a measure of assets that can be converted quickly into currency, such as demand deposits, coins and currency and checking accounts.

The latter includes what are known as "time deposits," such as money markets and savings deposits that can't be converted as quickly.

According to the latest Fed measurements, M1 is increasing at an annualized pace of 8.9 percent, while M2 is growing at a 5.4 percent clip.

Generally speaking, M2 and the rate of economic growth should be about the same.

That relationship held up well through history but has broken down over the past decade or so, with gross domestic product badly lagging monetary base growth. Liquidity injections from the Fed through its monthly bond-buying program—quantitative easing—have increased the money supply but not the velocity of money flowing through the economy.

(Read more: Perfect storm for inflation could rock the market)

Bove expects the relationship to normalize in the years ahead, with the economy speeding up and money velocity slowing down. Nominal GDP growth will peak out around 9 percent in 2016, according to the analysis.

"My view is that the nominal GDP is about to catch up," he said. "This means a stronger economy and a surge in inflation and interest rates.

"For banks, this would be nirvana. It means more loans at higher rates and wider spreads. This will drive bank earnings and bank stock prices."

(Read more: Bank stocks to double, says Dick Bove)

Along the way, though, he sees the 10-year yield rising from its current position around 2.8 percent to 3 percent in 2015 before spiking to 7 percent in 2016, 8 percent the following year, then back down to 7 percent in 2018—the year he expects a recession to set in.

"In two years the increase (in) inflation will drive financial asset values lower and the rally in bank stocks will end," he said.

For what it's worth, Bove predicted in January 2013 that banks would see a 14-year bull market.

—By CNBC's Jeff Cox. Follow him on Twitter @JeffCoxCNBCcom.