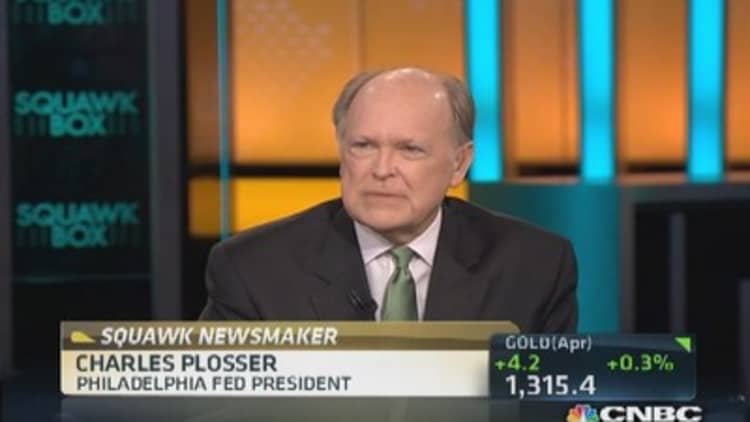

Philadelphia Fed President Charles Plosser told CNBC on Tuesday he found the market's reaction the last week's Fed statement surprising and that the Fed did not change its position on interest rates.

A noted hawk on the Fed's largely dovish board, Plosser said he believes interest rates should hit 3 percent by the end of 2015 and 4 percent in 2016.

"It's a little bit puzzling that the market would react the way it did," Plosser said on CNBC's "Squawk Box." "I don't think the Fed changed its position. In fact, it tried to say very explicitly in its statement that we believe forward guidance or the expectations have not changed as far as we're concerned."

Yellen later clarified her comments on interest rates, which she said may rise six months after the Fed ends its bond-buying stimulus programs, Plosser said. In its most recent policy statement, the Fed dropped an unemployment level threshold from its guidance on interest rates, but Plosser said the bank still plans to be "data dependent" when it weighs when to raise rates.

Yellen's comments were not a mistake, Plosser said.

Still, Plosser told CNBC it's more productive to talk about economic conditions rather than timing. He said Yellen's comments were in line with data and surveys that the Federal Open Market Committee used to measure the economy.

"There was a lot of evidence and a lot of surveys that suggest six months wasn't a wildly unexpected timeframe," Plosser said. "But it is better to get away from talking about timeframes. Talking about economic conditions is a much better way to think about it."

Plosser added: "I was surprised the market reacted as much as it did ... I don't count months. It's silly for us to contemplate raising rates until we stop purchases."

A noted fiscal hawk on the Federal Reserve's FOMC, Plosser has been a fierce critic of the central bank's massive economic stimulus program. He advised the Fed to wind down its bond-buying program sooner than Yellen plans.

(Read more: Why Kocherlakota won't become Fed's chief dissenter)

The 2008 financial crisis caused deeper wounds than previously thought, and the economy may never return to normal growth, Plosser told CNBC earlier this month.

—By CNBC's Jeff Morganteen. Follow him on Twitter at @jmorganteen.

CORRECTION: This article has been corrected to reflect subsequent information provided to CNBC by Philadelphia Fed President Charles Plosser that he believes interest rates should hit 3 percent by the end of 2015 and 4 percent in 2016. Plosser originally told CNBC that he expects rates to hit "2 and change" in 2015 and 3 percent in 2016.