Much has been made of the potential slowdown in Chinese economic growth, and Jim O'Neill thinks it's probably been too much.

The former Goldman Sachs chief strategist and coiner of the term "BRICs"—for Brazil, Russia, India and China—believes China remains a solid place for investing, though perhaps with a few caveats.

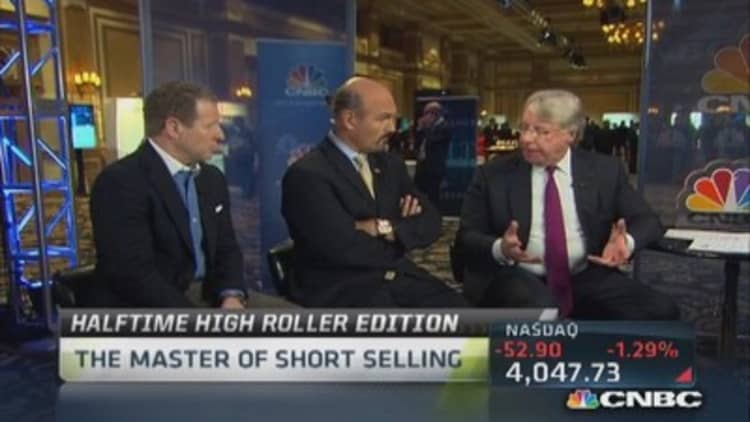

"If the other BRIC countries were doing what (China is) doing, the world would be a better place," O'Neill said Friday during a panel discussion on China and other developing countries at SkyBridge Capital's SALT 2014 conference.

In all, he said investors should keep four things in mind about China:

1.) "You have to be careful to distinguish between investing in China and what's going on with the economy."

Read MoreChanos: These are the best shorts in bull market

2.) Despite predictions of a possible "hard landing" as growth slows, O'Neill said the world's second-largest economy actually has exceeded expectations. "So far this decade China is the only one of the BRICs that has grown decade-to-date more than I assumed," he said. "Over the next year or two they might grow less than 7 and a half (percent), as low as 6 and a half (percent) possibly."

3.) Reform is progressing. "The government is more determined about changing than most people realize," he said. On this point, O'Neill had support on the panel: Jin Liqun, chairman of China International Capital, also made note of reform efforts. "The end of corruption is good for China because it's going to include the state governments," Jin said.

4.) The transition from an export-based economy to one more driven by consumers is proceeding, evidenced by the closing gap between industrial production and retail sales.

Read MoreAlibaba vs Tencent: Who is winning in China?

O'Neill is not just focused on China, however,

He has coined a new term "MINTs" for Mexico, Indonesia, Nigeria and Turkey, countries he believes are poised for growth in the years ahead.

O'Neill sat on the opposite side of the stage from perhaps the most notorious China bear, Jim Chanos, the billionaire Kynikos Associates chief. Among other things, Chanos believes the nation's "ghost cities" with "rows and rows of empty homes" will prove a heavy burden to bear.

Interestingly, though, he said China is not the biggest Asian threat. Chanos reserved that distinction for Japanese Prime Minister Shinzo Abe, due to his efforts to rearm his country.

Read MoreWill doom follow Japan's first quarter boom?

"I think he begins to destabilize the area from a political and military point of view more than any Chinese leader," Chanos said.