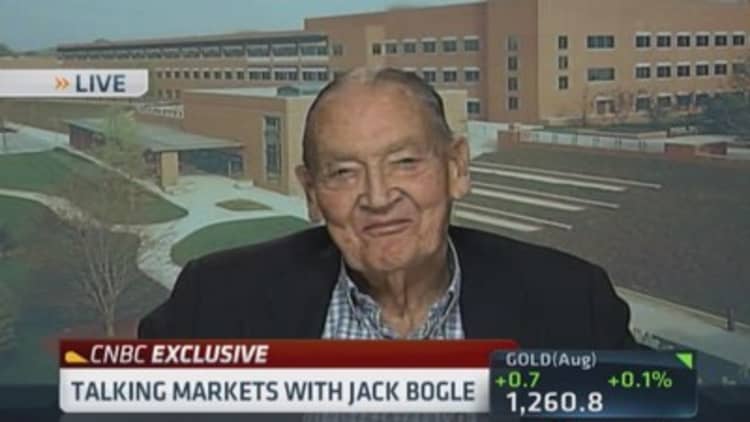

Investors should accept the market return for what it is because they are better off investing in stocks versus commodities or gold for the long run, says Vanguard Group founder Jack Bogle.

"Stocks have a well-known internal rate of return," the president of Bogle Financial Market Research said on CNBC's "Closing Bell."

"Stocks have earnings underlying their value, and they pay out dividends that we underrate greatly year after year, usually in a very steady form."

Read More Is Market Reward Still Worth The Risk

Bogle, who is No. 9 on CNBC's First 25 List, said owning part of a business is very appealing because whatever is left after the dividends are paid out is reinvested back into the company, thus furthering its growth.

Read MoreGrowing Stock Market Bullishness Not A Concern Yet

Despite the recent upswing in market all-time highs, global retail investors are holding up to 40 percent of their assets in cash, according to research conducted by State Street's Center for Applied Research. This number is up from 31 percent just two years ago.

However, Bogle's not buying that figure. "I'm extremely dubious about the 40 percent figure….it's probably 20 percent maybe."

Read MoreJack Bogle: Why investors shouldn't fear flash trading

—By CNBC's Laura Petti