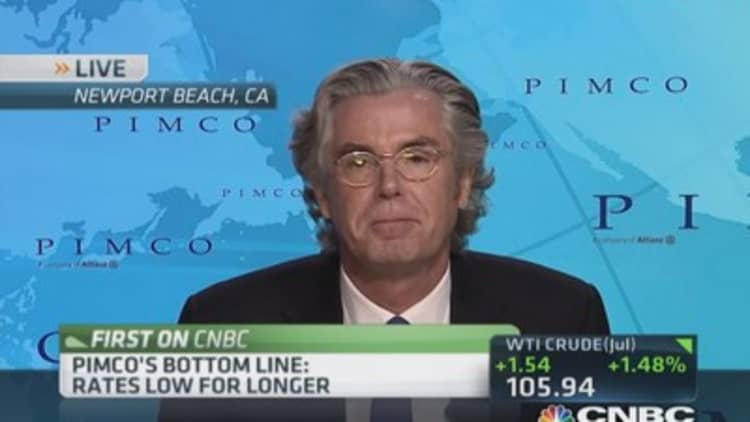

The war against inflation has been won, and rates will continue to remain low, Pimco chief economist Paul McCulley told CNBC Thursday.

"For the last 15 years inflation has been incredibly absent," McCulley said in an interview with "Power Lunch."

"We've had our cyclical ups and downs but when you look at it on a chart, I think we've achieved the promised land of price stability over many cycles."

Because of that, the Federal Reserve does not need to engage in pre-emptive tightening and therefore will change the way it cyclically fine tunes the economy.

"I think the Fed will tighten next year, but it's not trying to pre-empt an increase in inflation. In fact, the Fed's told you it won't hike until after inflation has moved up closer to target. That is a profound paradigm change," McCulley said.

In addition, he believes there will be a structural reduction in the neutral real Fed funds rate—instead of the 4 percent the market usually expects, he said the rate will be closer to 2 percent.

"The new reality, having won the war against inflation, escaping the liquidity trap, is no pre-emption on tightening, and a stopping point in the neighborhood of 2 percent nominal."

Read MoreThis is a blight on our economy: Pimco's McCulley

That means both the bond market and the stock market are fairly valued, he said.

"If I still believed in a 4 percent neutral Fed funds rate then sell everything you can get your hands on, but if you believe in 2 [percent], the markets are in a fair zone of valuation," McCulley said.

He doesn't expect the bond market to move a lot higher because it is priced near 2 percent, but said stocks can go up based on underlying economic growth and corporate earnings.

Read MoreWhy in the world do people keep buying Treasurys?

—By CNBC's Michelle Fox