London-listed drugmaker Shire has hired investment bank Citi as an adviser, expecting to receive takeover approaches following a wave of deals in the healthcare sector, sources familiar with the matter told Reuters.

Much of the dealmaking has been fueled by U.S. companies seeking lower tax rates abroad. With its tax base in Ireland - where effective corporate tax rates are among the lowest in the world—and a mid-sized market value of around $35 billion, Shire could be a prime target, analysts and bankers believe.

"Something could happen this year," said one of the sources on condition of anonymity because the matter is private.

Shire, which specializes in treatments for attention deficit hyperactivity disorder (ADHD) and a range of rare diseases, was not immediately available to comment. Citi declined to comment.

Read More Diabetes: The $54 billion battleground

Shire, which was founded in 1986 in Britain but conducts most of its business in the United States, has been domiciled in Ireland for tax purposes since 2008.

It has already been approached by Botox-maker Allergan months before the U.S. group itself became a takeover target for Valeant, Reuters reported earlier this year.

That approach did not lead to serious discussions between the two parties and there are currently no talks with Allergan, one source said.

Shire is a relative rarity in being a mid-sized drug-maker with no controlling shareholder, making it a perennial subject of takeover speculation.

Sector bankers think it could appeal to U.S. pharmaceutical and biotech firms such as Bristol-Myers Squibb, Amgen , Abbvie, Gilead and Biogen.

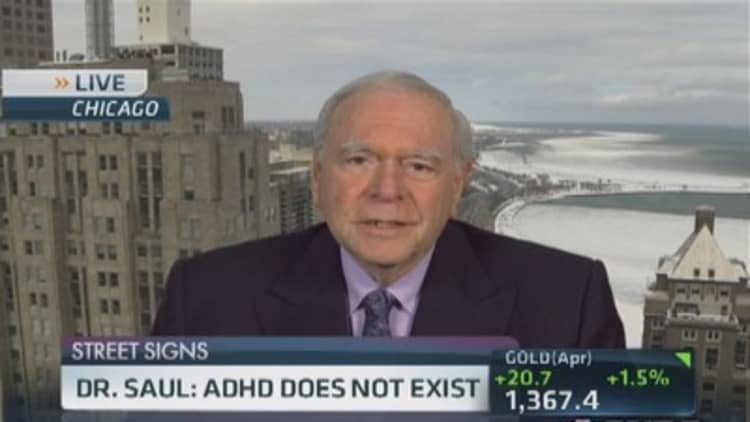

But Shire's reliance on ADHD drugs has put off potential bidders in the past, as using stimulants to treat ADHD in children is controversial in some doctors' eyes, they added.

ADHD medicines account for around 40 percent of Shire's sales. The firm also sells pricey drugs to treat rare genetic disorders and is building up a portfolio of treatments in ophthalmology and other specialty disease areas.

The current imperative for major drugmakers to keep up with rivals in terms of a low tax rate and to use offshore cash that would otherwise be taxed punitively if brought back home, could now be changing the calculation, some industry watchers believe.

Read More With Idenix gone, is Achillion next?

Inversion Deals

"The benefits of lower taxation is a key M&A driver in this cross-border wave of U.S./EU healthcare deals," said one pharmaceuticals analyst on condition of anonymity.

"Shire would make another attractive target despite the fact that it is a niche business and sells amphetamines."

The race to strike so-called "inversion" deals offering lower tax rates was underscored at the weekend when U.S. medical device maker Medtronic agreed to buy Covidien for $42.9 billion and move its base to Ireland.

Ireland is a particularly attractive destination for such transactions since it has a 12.5 percent corporate tax rate, compared with 35 percent in the United States.

Read More The $84,000 question: Will focusing on drug prices rein in costs?

A Reuters review showed about 50 such inversion deals had been done in the past 25 years, with half occurring since the 2008-2009 financial crisis abated.

"Any halfway decent, EU-based company will be looked at very seriously. The latest deals have upped the ante. The metric of purely strategic rationale has been put aside - anything is possible," said one sector banker, who added that two or three more possible inversion deals could happen soon.

Some U.S. lawmakers are concerned the deals erode government revenue by giving corporations a tax-avoiding loophole. Two bills in the U.S. Congress and a White House proposal would make inversions harder to do, but neither has gained much traction. That could change if another major U.S. company or two tried to conduct inversions, tax lawyers and analysts said last week.

U.S.-based Pfizer's $118 billion bid for British drugmaker AstraZeneca was rejected last month, scuppering what would have been the largest such inversion deal, but there is speculation talks may yet revive.

Under British takeover law, the UK firm can approach Pfizer at the end of August to discuss a sweetened bid, or Pfizer can try again in November.

Read More Rx for drugstore sticker shock? It's not Obamacare

— By Reuters