Asia's markets aren't likely to repeat the taper tantrum selloffs as the Federal Reserve edges closer to eventual policy tightening, analysts said.

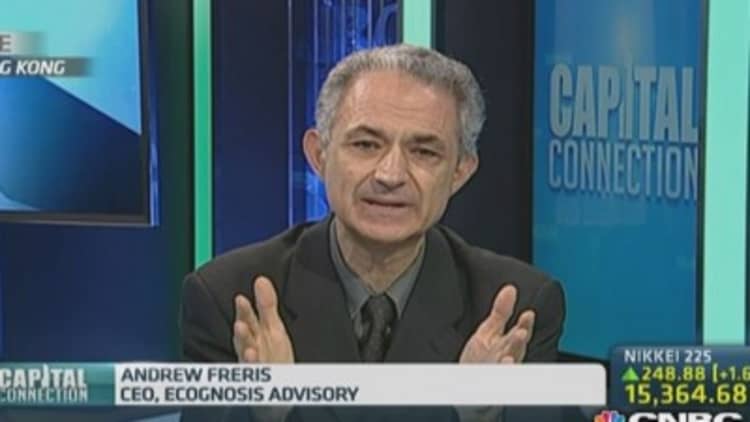

"This insistence that somehow we follow American interest rates [in Asia] is just not true," Andrew Freris, CEO of Ecognosis Advisory, told CNBC. "We have decoupled a long, long time ago," he said.

"Simple example: the best performing market in Asia right now year-to-date in U.S. dollar terms is India. The third best performing is Indonesia. Both of them have seen increases in their local interest rates in the last six months," he said.

Read More Will emerging markets throw a tightening tantrum?

As the Fed continues to taper its asset purchases, announcing Wednesday plans to reduce its bond-buying program by another $10 billion to $35 billion a month, some analysts are concerned that the approach of the first interest rate hike could cause a repeat of the convulsions suffered by emerging markets last year and early this year.

Many analysts believe the Fed's easy money policy caused a rush of funds into Asia, and they expect tightening will reverse those flows, but Freris doesn't accept that view.

Read More Interest rates don't matter? Federal Reserve paper says so

"It isn't true that [when] the Fed begins to suck money, you hear a huge whoosh and money that went in will go out," he said. "There has never been a wall of money coming into Asia" from the Fed's quantitative easing, he said, adding that fund inflows to the region were due to portfolio adjustments by existing funds as markets turned risk positive.

"Asia is not going to be on a reverse tsunami," he said.

Others have also raised doubts about whether the Fed's quantitative easing actually sent funds flowing into Asia's markets.

Read More This asset class may be the superstar of the second-half

"All those wheelbarrows of cash that the Fed 'dumped into the economy' never went into the economy at all. They went straight into the Fed's basement in the form of excess reserves" as banks parked the proceeds of selling their bonds to the Fed back at the Fed, David Carbon, chief economist at DBS Group, said in a note last week. "It can't go rushing over to Asia the next day."

Carbon believes low global interest rates were irrelevant to Asia market gains, with fund flows actually part of a structural shift in "economic gravity" away from the West and toward the East.

"In the midst of the biggest crisis in 100 years, Asia added an entire Germany to the world's economic map," he said. "Asia now adds a Germany every 3.5 years," he added. "It's brute force growth."

He expects "capital will flow to Asia like never before."

DBS doesn't expect a near-term correction for Asian equities, noting they look "extremely cheap," with the MSCI China's forward price-to-earnings ratios around half the S&P 500.

Read More Calls to scoop up emerging market assets grow louder

To be sure, Freris doesn't think Asian markets will escape scot-free when the Fed's first hike becomes imminent.

"The moment (Fed chief Janet) Yellen somehow says I'm pressing the red button, we're going to have a knee jerk reaction," he said. "Everybody, including Asia, is going to be hit."

Once the knee-jerk reaction is over, however, "we are back again to where we were before."

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1