The European Central Bank (ECB) gave further details of its new long-term lending program for banks on Thursday, after keeping monetary policy unchanged.

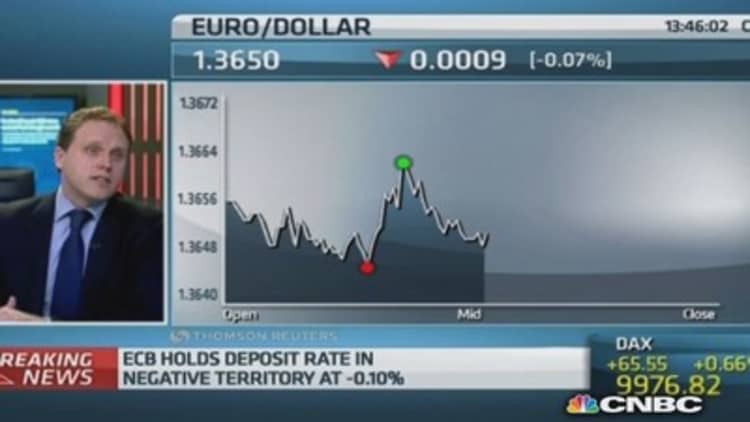

The bank maintained interest rates at their current levels, with the main refinancing rate at a record low of 0.15 percent.

At his regular post-decision press conference, ECB President Mario Draghi also announced that the frequency of the bank's meetings would change to a six-week cycle from January 2015, and that it would start publishing minutes of its policy meetings.

Analysts expected the ECB to hold fire this month, after it announced a series of measures in June to combat the euro zone's growth-sapping disinflation and spur its recovery. These measures included a negative interest rate on banks for parking deposits with the ECB and a 400 billion-euro ($546 billion) loan program for banks.

"After last month's monetary policy fireworks, the ECB took it easy today... Instead, the ECB obviously remains in a state of high alert," said Carsten Brzeski, senior economist at ING, in a note.

But Brzeski said the change in frequency of meetings came as a surprise, and outlined three likely reasons behind the shift.

"1) It gives the ECB more time to reflect on data developments between meetings and should take away some pressure for imminent action; 2) It accommodates the publication of minutes, which in the 4-weeks rhythm could already have an impact on market expectations for the upcoming meeting; and 3) the new rhythm will better match the rotation scheme in the decision-making of the Governing Council, which will also start in January 2015," Brzeski said.

Lending program details

Draghi gave more details of the central bank's lending program—known as targeted longer-term refinancing operations, or as TLTROs— on Thursday.

He said banks tapping the cheap loans must use them to lend or else be forced to pay the money back. The ECB hopes to avoid a repeat of what happened under previous LTRO programs, when banks used large chunks of the loans to buy their own government's debt.

Banks can participate in the scheme either individually or as a group. They can borrow a sum equal to 7 percent of the total loans to the euro area non-financial private sector as of April 30, 2014. The operations will take place on September 18 and December 11.

The region's economy certainly needs all the help it can get, with two closely watched economic indicators—Markit's Purchasing Managers' Index and the European Commission's Economic Sentiment Indicator—weakening in June.

Retail sales across the 18 countries which share the euro also disappointed, coming in flat in May, according to data published Thursday.

In the first quarter, the euro zone's economy grew by just 0.2 percent, quarter-on-quarter, and unemployment remains stubbornly high, at 11.6 percent.

—Reuters contributed to this report.