(Click for video linked to a searchable transcript of this Mad Money segment)

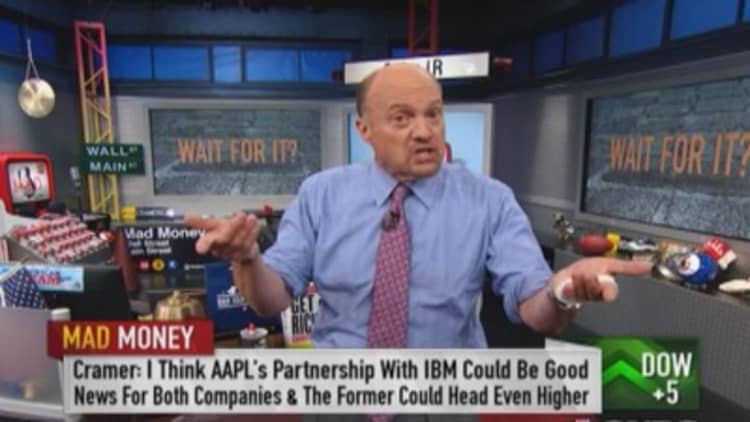

"While a newly announced partnership is good news for IBM, I think it's amazing news for Apple," said Jim Cramer.

That was the "Mad Money" host's immediate reaction after learning that the two tech behemoths had inked a deal to create global business apps.

Specifically, IBM said it would create a class of more than 100 business apps exclusively for iPhones and iPads to run on Apple's iOS platform. In return, IBM will sell Apple's products filled with 100 industry-specific apps to its clients worldwide.

"I believe, through this deal, IBM will shepherd Apple into the highest reaches of a huge portion of the enterprise market that currently doesn't support Apple's products," Cramer said.

In other words, because of the partnership, Cramer thinks Apple could become a major player in the business market, an area that has otherwise been elusive for Apple.

"How frustrating has it been that so many of the companies we work for don't support Apple's hugely popular personal computers, tablets and smartphones? How many times have you tried to get your company to adopt Apple? How often have you called IT and been told, 'Sorry, we don't support Apple'? I think with this watershed announcement today, that's all going to change."

Although Cramer has been saying for quite some time he's a buyer of Apple, rather than peg his optimism to only the developments outlined above, he said his enthusiasm also stems from digging deep into Apple's metrics.

"Even after a 20 percent run this year, Apple still sells at a big discount to the average stock in the S&P 500," Cramer said. "It's the cheapest large cap growth stock I follow and good things tend to happen to stocks that are both solid and inexpensive."

In keeping with that theme, Cramer added that Apple isn't the only stock in the market that's both solid and inexpensive. "There's also Intel," he said.

-------------------------------------------------------------

Read more from Mad Money with Jim Cramer

Street deserves 'F' for these stocks

Piggyback Peltz into BNY Mellon

Why Manitowoc could have 30% upside

-------------------------------------------------------------

And outside the tech sector, Cramer identified JPMorgan and Goldman Sachs as two other stocks that met the same criteria as Apple, again solid and inexpensive.

"Both sell at 10 times earnings while the S&P currently trades at 17 times earnings," he said. "I own both stocks for my charitable trust. I think it's absurd that either trade at such a huge discount."

And on Tuesday it appeared Cramer's outlook was confirmed. Both banks beat Street expectations with shares of closing 1 percent higher while popped 3 percent in a single session.

"I think this is just the beginning of the outperformance. JPMorgan and Goldman used to sell at a premium to the average stock. Now I think it's dawning on people that we're finally at the tail end of the bad, and the beginning of the good. They are solid and inexpensive like Apple. That's when good things tend to happen. I believe these stocks are heading much higher. You don't have to take on too much risk to have a terrific reward."

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com