Oil prices fell on Wednesday, with Brent leading the decline weakened by excess supplies in Europe and Asia, while U.S. crude pared gains despite a larger-than-expected drop in nationwide stockpiles.

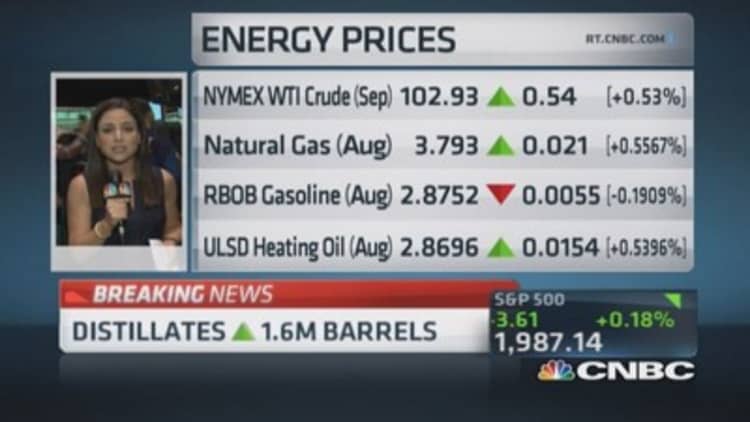

The oil markets moved hesitantly in midmorning trading after the U.S. Energy Information Administration said crude inventories fell by 3.7 million barrels last week, while gasoline and distillate stocks rose.

The bigger-than-expected draw in U.S. crude stocks prompted a short rally, but both Brent and U.S. crude soon turned negative, as traders and investors worried about weak demand and excess of supplies both in the United States and worldwide.

Brent crude, which has been trading between $106-$109 over the past two weeks, was off more than $1 to near $106 a barrel. U.S. crude was down 70 cents to settle at $100.27 a barrel.

Inventories at the Cushing, Oklahoma, delivery point for the U.S. crude contract have fallen to their lowest level in six years, putting more scrutiny on local supplies in the area. The weekly EIA report showed that Cushing stocks fell by a further 924,000 barrels to 17.9 million barrels

Brent, the international benchmark for North Sea crude, led the decline earlier in the session, as fears of political tension in key regions were offset by ample supplies. Traders said North Sea and West African physical crude markets were oversupplied, with sellers discounting heavily in an effort to attract buyers such as oil refiners.

The crisis between Russia and the West continued to keep the market on edge after the European Union and the United States imposed further sanctions against Moscow on Tuesday for its support of pro-Moscow rebels in Ukraine.

--By Reuters. For more information on commodities, please click here.